Any day in SIP is fine as long as we continue for 8 years to create good wealth

Invest Rs. 1 Lakh and get Rs. 25,000 monthly interest :: Warning!!

Invest 1 Lakh and get Rs. 25,000 monthly interest :: Warning!! Last few months, I keep getting calls from my clients and friends to advise on the scheme where you just have to invest 1 lakh as capital and you can recover the capital in 4 months and get unlimited interest pay…

World Savings Day October 30

World Savings Day *World Savings Day -- a day devoted to the promotion of savings -- is celebrated on October 30 all over the world Everyone wants to earn more and get rich as quickly as possible. However, to do that, it's important to think one step ahead of saving money…

Mutual funds have emerged as the #1 Financial investment instrument in India'

Mutual funds have emerged as the #1 Financial investment instrument in the country, says the survey from Scripbox Tomorrow is too late Yesterday is over Now is the right moment START investing in Mutual Funds

A Personal Finance Webinar on “Myths about Wealth Creation”

A Personal Finance Webinar on "Myths about Wealth Creation" Holistic Investment Planners invite you for a Personal Finance Webinar on "Myths about Wealth Creation" Guest Speaker: Mr. Deepak Mehta - Head of Sales Management - UTI AMC Ltd. Date: 19.11.2022, S…

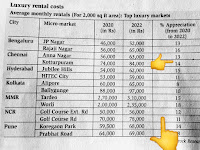

Despite Appreciation in Rental Yields in 2years, STILL Renting is so, so cheaper than owning

Despite Appreciation in Rental Yields in 2years, STILL *Renting is so, so cheaper than owning*. For Rs. 3 crores property, Just pay 60,000 RENT, which is just 2.4% per annum. Buying with EMIs & Loan, Luxury apartments doesn't make any sense for investment. N Vijay k…

Investors considering to purchase gold for investment purpose this Diwali can consider Gold ETFs

Mr Chintan Haria, ICICI Prudential AMC, on *Investors considering to purchase gold for investment purpose this Diwali can consider Gold ETFs* Buying gold on auspicious occasions is a part of the Indian tradition. Apart from cultural and traditional reasons, gold also has a…

Muhurat Trading -Outlook by JM Financial Services

Muhurat Trading -Outlook by JM Financial Services On the occasion of Muhurat Trading, we wish to share the below outlook on behalf of JM Financial Services: _Nifty is at a crucial inflexion point of 17,600 above which we can expect an aggressive price action with targets of 1…

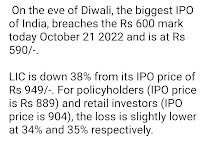

One should be very careful with IPO, especially those aggressively marketed at high price.

On the eve of Diwali, the biggest IPO of India, breaches the Rs 600 mark today October 21 2022 and is at Rs 590/-. LIC is down 38% from its IPO price of Rs 949/-. For policyholders (IPO price is Rs 889) and retail investors (IPO price is 904), the loss is slightly lower at…