by Mr Deepak Jasani, HDFC

Securities. Investing in mutual funds should ideally be

for the long term. However, it is essential to periodically

review the performance of the schemes by studying the historical returns of

that scheme and comparison with the returns of benchmark …

First-time Equity Investor : Is Mutual fund Ideal?

First-time Equity Investor : Is Mutual fund Ideal? by Mr. Kaushlendra Singh Sengar, Advisorymandi.com If you are new to stock market, then it is

advisable not to invest without knowledge. Stock market is not a gamble, it is a

business. However, we make it a gamble by invest…

Managing Debt: How to pay off Credit Card Loan, 7 Best Tips

Managing

Debt: How to pay off Credit Card Loan..! By Mr. P Saravanan, IIM Shillong Avoid revolving your credit, opt for balance

transfer of your outstanding amount and convert outstanding debt into EMI

option. Credit cards are often described as a debt

trap when used uncontrol…

28% GST detrimental to the existence of amusement park industry

28% GST detrimental

to the existence of amusement park industry Industry being categorized alongside casinos, betting and race course Mumbai, May 31, 2017: The recently

announced Goods and Services (GST) tax by the Government of India, has put the

very existence of India’s am…

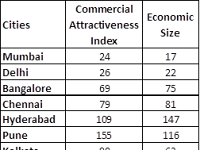

9 Indian Cities in JLL’s latest ‘Global 300’ Rankings

9 Indian Cities in JLL’s latest ‘Global

300’ Rankings by Mr. Ramesh Nair, JLL India A

total of nine Indian cities figure on the latest edition of ‘Global 300’ cities

– the annual JLL ranking exercise, which represents 300 major cities that are

the focus of commercial activit…

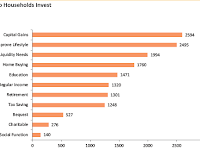

Why do Indian Households Invest? Top 10 Reasons..!

Why do Indian Households Invest? Top 11 Reasons..! Form SEBI Investor Survey 2015 1. Capital Gains 2594 2. Improve Lifestyle 2495 3. Liquidity Needs 1994 4. Home Buying 1760 5. Education 1471 6. Regular Income 1320 7. Retirement 1301 8. Tax Saving 1248 9. Bequest 527 10. Char…