**1) Company Name - Icici Lombard GIC* 2) *Why Health Insurance Is important* - *) *To Protect your Savings* *) *We don't depend on others* *) *If we r having health Insurance means, we have lot of confidence in ourself* *3) 100% cashless with Non Medical expenses also …

GDP projection by IMF & Goldman Sachs:

GDP projection by IMF & Goldman Sachs: 🇨🇳 China GDP: 2023: $19.374 trillion 2028: $27.4 trillion 2075: $57 trillion 🇮🇳 India GDP: 2023: $3.737 trillion 2028: $5.5 trillion 2075: $52.5 trillion 🇺🇲 US GDP: 2023: $26.855 trillion 2028: $32.3 trillion 2075: $51.5 trillion 🇮🇩 I…

Index Funds There were 19 funds in this category with 10+ yrs of data available.

Index Funds There were 19 funds in this category with 10+ yrs of data available. The topmost fund returned 41.7 lacs for the investment of 10 lacs and the worst did return 30.6 lacs. Here is the data in the chart.

Edelweiss US tech fund for the last 3 years.

Most of my clients have had allocation in Edelweiss US tech fund for the last 3 years. I believed in this concept and also encouraged my clients to invest and stay invested in the downtrend Some of them exited prematurely, citing negative returns. However, the fund has sinc…

Handling volatility in bull markets is easy.

Handling volatility in bull markets is easy. Handling volatility in bear markets is damn hard.

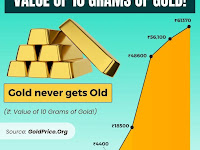

2003 to 2023 gold 600rs to 6000rs 10× returns in 20 years one gram

2003 to 2023 gold 600rs to 6000rs 10× returns in 20 years one gram 2023 to 2043 gold 10× returns in 20 years 60000rs? One gram gold just 6% returns every year so gold price 19250rs? One gram

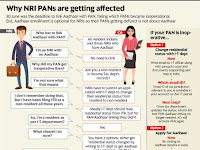

If you are a NRI, you dont have to link your pan to Aathar What happens ?*

If you are a NRI, you dont have to link your pan to adhar. But, if you have Adhar you *should better link it.* *What happens if you dont link?* 1. Mutual Fund transactions will not be allowed. (Including SIP) 2. Cannot buy/sell shares 3. Cannot file ITR 4. Cannot make Life insura…

For Coimbatore based investors - TIA’s SEBI meeting open to all.

For Coimbatore based investors - TIA's SEBI meeting open to all. https://docs.google.com/forms/d/e/1FAIpQLScugrMuICdyLiEYNvRVYMvKHyGbAi8QlQG-6N2R77TYvDLuEA/viewform?usp=pp_url RSVP form for interested people!

Bank of India : Mahila Samman Savings Certificate 2023

Bank of India Rolled – Out Mahila Samman Savings Certificate, 2023 · First bank to operationalize this scheme at all its branches · The scheme offers an interest rate of 7.5% per annum, compounded quarterly. : Bank of India, one of the largest Public Sector…

important points on PAN-Aadhaar link & associated actions:

❗ PANs which are not linked to Aadhar, would be come inoperative with effect from 1st July 2023 ❗ *Few important points on PAN-Aadhaar link & associated actions:* *Transaction type:* Physical / Online/Exchange Transactions ❌Prospect Folio - Not allowed ❌Fresh Purchase - Not …

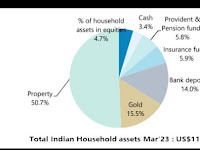

ABSL Multi Asset Allocation Fund - a unique blend of 3 asset classes - Equity, Debt and Gold in 1 fund

Multi Asset Allocation Fund . Diversification of investments is now widely accepted as a time-tested strategy. It's, therefore, no longer a secret mantra that one needs to have allocations across multiple asset classes, in their investment portfolios to get the be…

When Nifty 50 is all time high, Nifty IT Index is still half way down the line.

When Nifty 50 is all time high, Nifty IT Index is still half way down the line. There is clear discount of 10000 Points for its All time high.

Is Bajaj Finance the best Lending Financial stock in Indian Market?

Is Bajaj Finance the best Lending Financial stock in Indian Market? Stock Price CAGR 10 Years: 48% 5 Years: 26% 3 Years: 36% 1 Year: 30%

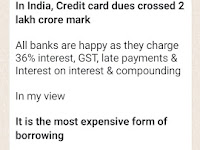

In India, Credit card dues crossed 2 lakh crore mark

In India, Credit card dues crossed 2 lakh crore mark All banks are happy as they charge 36% interest, GST, late payments & Interest on interest & compounding In my view *It is the most expensive form of borrowing* I have written an article in the past with Rs1 Formula*…

Sensex Crossed 65000* for the first time!

Sensex Crossed 65000* for the first time! Foreign institutional investors (FIIs) showed a favorable stance in the cash market, being net purchasers of Rs 20,852 crore during the June series. These positive actions by FIIs contribute to the overall performance of the Index. 1.…

Analysis of the last 𝟰𝟯 𝘆𝗲𝗮𝗿𝘀 𝗼𝗳 𝗱𝗮𝘁𝗮 𝗼𝗳 𝗦𝗘𝗡𝗦𝗘𝗫

Analysis of the last 𝟰𝟯 𝘆𝗲𝗮𝗿𝘀 𝗼𝗳 𝗱𝗮𝘁𝗮 𝗼𝗳 𝗦𝗘𝗡𝗦𝗘𝗫 🔰 There were around 𝟭𝟭,𝟬𝟬𝟬 𝘁𝗿𝗮𝗱𝗶𝗻𝗴 𝗱𝗮𝘆𝘀 in the last 43 years. 🔰 Observations on positive and negative return occurrences. 𝗗𝗮𝗶𝗹𝘆 - 53% time Positive and 47% time Negative. 𝗪𝗲𝗲𝗸𝗹𝘆 -…

No Changes in post office Interest Rates (for Jul-Sep 2023)

No Changes in Interest Rates (for Jul-Sep 2023) PPF - 7.10% - No Change SCSS - 8.20% - No Change SSY - 8.00% - No Change NSC - 7.70% - No Change KVP - 7.50% - No Change RBI FRB - 8.05% (Jul-Dec 2023) EPF - 8.15% (FY22-23)