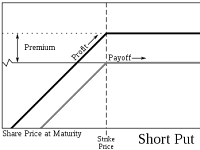

The risk of an Options Writer is unlimited whereas his / her gains

are limited to the Premiums earned. When an uncovered call is exercised for physical delivery, the

call writer will have to purchase the underlying asset & his / her loss

will be the excess of the purchas…

Showing posts with label Share - Future and Options. Show all posts

Showing posts with label Share - Future and Options. Show all posts

Once have bought an option and paid the premium for it, how does it get settled ?

Option is a contract, which has a market value like any other

tradable commodity. Once an option is bought there are following alternatives that an

option holder has: You can sell an option of the same series as the one you had

bought and close out / or square off your posit…

Why should invest in Options? What do options offer ?

Besides offering flexibility to the buyer in the form of right to buy or / sell, the major advantage of options is their versatility.

They can be as conservative or / as speculative as one's investment strategy dictates. Some of the benefits of Options are as under:

·…

Major players in the Options Market..

The Major players in the Options Market ? Developmental institutions, Mutual Funds, Domestic and Foreign

Institutional Investors are the likely major players in the Options Market. Also share Brokers, Retail participants are the likely players in the Options Market.

Explain the Option Greeks.. ?

The

price of an Option depends on certain factors like price and volatility of the

underlying, time to expiry etc. The

option Greeks are the tools that measure the sensitivity of the option price to

the above-mentioned factors. They

are often used by professional traders for…

Options Trading: Time Value With Reference ..

Time

value is the amount option buyers are willing to pay for the possibility that

the option may become profitable prior to expiration due to favorable change in

the price of the underlying. An option loses its time

value as its expiration date nears. At expiration an opti…

How to Decides on the Premium Paid on Options Trading ?

How to Decides on the Premium Paid on Options Trading. How is it

Calculated ? Options

Premium is not fixed by the Stock Exchange. The

fair value / or theoretical price of an

option can be known with the help of pricing models and then depending on market conditions the pr…

The Factors that Affect the Value of An Option premium..

There

are 2 types of factors that affect the value of the option premium: They

are Quantifiable Factors and Non Quantifiable Factors.. Quantifiable

Factors.. * Underlying stock price * The strike price of the option * The time to expiration and

* The volatility of the

underlying s…

NSE, MCX-SX get Approval For Interest Rate Futures

The Securities and

Exchange Board of India (SEBI) has permitted NSE and MCX-SX to launch interest

rate futures. NSE will launch trading in this instrument on January 21, 2014

while MCX-SX will commence trading within this month.

Both the exchanges

will launch the product …

Different Pricing Models for Options..

The

theoretical option pricing models are used by option traders for calculating

the fair value of an option on the basis of the earlier mentioned (Quantifiable

Factors and Non Quantifiable Factors) influencing factors.

The 2

most popular option pricing models are.. 1.

Bla…

Call and Put Option Trading: What is the Intrinsic Value ?

The

intrinsic value of an option trading is defined as the amount, by which an

option is in - the-money, or / the immediate exercise value of the option when

the underlying position is marked - to - market. (mtm) For a

call option..

Intrinsic

Value = Spot Price - Strike Pri…

Call Option : What are Naked Calls ?

Covered

calls are far less risky than naked calls (where there is no opposite position

in the underlying), since the worst that can happen is that the investor /

trader is required to sell stocks already owned at below their market value.

When a

physical delivery uncovered …

Call Option : What are Covered Calls ?

A call

option position that is covered by an opposite position in the underlying

instrument (for example shares, Index, commodities etc),is called a covered

call.

Writing

covered calls involves writing call options when the stocks that might have to

be delivered (if option…

“Tri-Series” Training and Development Programme on Financial Derivatives..!

"Tri-Series" Training and Development Programme on Financial Derivatives - Leve 0 - on 9 and 10 March 2013, Level 1 - on 6 and 7 March 2013 Level 3 - on 27 and 28 April 2013 The programme organised by PSG Institute of Management For more details http://psgim.ac.in…

Futures and Options : Shares, Symbols and Lot Size shares..!

Futures and Options : Shares, Symbols and Lot Size shares..! UNDERLYING SYMBOL Lot -Shares as on Jan-2013 CNX BANK INDEX BANKNIFTY 25 CNX INFRASTRUCTURE INDEX CNXINFRA 100 CNX IT CNXIT 50 CN…