Q Please, Explain - In the Money, At the Money & Out of the money in Options.. ? An option is told to be 'at-the-money', when the option's strike price is equal to the underlying asset price. This is true for both puts & calls Options. A call option is sai…

Showing posts with label Share - Future and Options. Show all posts

Showing posts with label Share - Future and Options. Show all posts

National Stock Exchange : Exclude Suzlon Energy, Gujarat Fluoro from F & O..!

The National Stock Exchange (NSE) has excluded Suzlon Energy & Gujarat Flurochemicals from futures & options segment. This will take effect from March 1, 2013. However, trading would be available for December, January and February 2013 series.

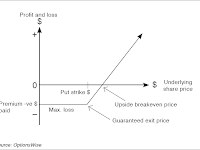

What are Put Options, With Example ?

Q : Please explain, What are Put Options? Also give an simple example? A: A Put option gives the holder (buyer / one who is long Put), the right to sell specified quantity of the underlying asset at the strike price on or / before an expiry date in case of American option. The…

How are Share Trading OPTIONS different from FUTURES ?

The major differences in Share Trading Futures and Options are below..!: ** Futures are agreements / or contracts to buy or / sell specified quantity of the underlying assets (Shares or Index) at a price agreed upon by the buyer and seller, on or / before a specified time. …

SHARE TRADING CALL OPTIONS and PUT OPTIONS DIFFERENCE..!

DETAILS CALL OPTIONS PUT OPTIONS Option buyer or / option holder. Buys the right {Contract} to buy the underlying asset at the specified price. Buys the right (Contract) to sell underlying asset at the specified price. Option seller or / option writer. Has the obligation t…

Option Assignment..!

When holder of an option exercises his / her right to buy / or sell, a randomly selected (by online / or computer) option seller is assigned the obligation to honor the underlying contract, and this process is termed as option Assignment.

Derivatives – Unspoken Scam by Mr. M.R. Venkatesh

Chennai based Hindustan Chamber of Commerce organised a share market related meeting at Hindustan Chamber of Commerce office (Greams Dugar, 5th Floor, South Wing, 149, Greams Road, Chennai–600 006). This meeting held on Friday, the 7th December 2012 Topic: Derivatives – Unsp…

What are Call Options in Share Trading?

Q: Please Explain Call Options in Share Trading with a simple example? - Mr. Suresh Babu, Chennai - 600 017 Via E mail A: A call option gives the holder (buyer / one who is long call), the right to buy specified quantity of the underlying asset (Share or Index) at the strike pr…

European and American Style of Option Tradings..!

Generaly Options Trading are two types. One is American style option. Other is European style option. An American kind of option is the one which can be exercised by the buyer at any time, till the expiration date, that is anytime between the day of purchase of the option …

Main Terminology in Options Trading..!

Option Premium..! The premium amount is the price paid by the buyer to the seller to acquire the right to buy or / sell a stock or Index. Strike Price or / Exercise Price..! The strike or / exercise price of an option is the specified / or pre - determined price of the under…

SEBI Bans Mini F & O Contracts : Whar Impact On Derivative Market?

The capital market watchdog SEBI (Securities and Exchange Board of India) had directed stock exchanges to discontinue mini derivative contracts on Sensex & Nifty that were essentially launched to attract retail investors to the F&O segment. NSE (National Stock Exchan…

Five Years After Launch, SEBI Bans Mini F & O Contracts

The capital market watchdog SEBI (Securities and Exchange Board of India) had made it clear that it is not in favour of small (retail) investors trying their luck with complex derivative ( Future and Options - F&O) products. SEBI had directed stock exchanges to discontinu…