The Union Finance Minister Mr. Arun Jaitley said that better facilities and

services to the income taxpayers are the central to Direct Tax Reforms. He said, Te income tax

payers have a right to know the deductions made from their salary / income on

regular basis. More and mo…

Showing posts with label Income Tax. Show all posts

Showing posts with label Income Tax. Show all posts

Mutual fund investment: Ways to calculate Income Tax on SIP

Investment GuruWednesday, October 12, 2016Alerts - Income Tax, Income Tax, Mutual Funds - SIP, OCT 2016

No comments

Mutual fund investment: Ways to

calculate Income Tax on SIP By Ms. Preeti Khurana, www.cleartax.com Those who invest in mutual funds via systematic

investment plan (SIP), will agree how simple and easy it is. Your money is

invested automatically in your choice of funds. Howev…

Mutual Fund Investment: What are Tax Savings Solutions?

Investment GuruSunday, September 25, 2016Alerts - Income Tax, Income Tax, Mutual Fund Investors, Mutual Funds, News - SEPTEMBER 2016, Tax Saving Investment - MF

No comments

Mutual Fund Investment: What

are Tax Savings Solutions? Birla

Sun Life MF Tax Savings Solutions What are Tax Savings Solutions? Birla

Sun Life MF Tax Savings Solutions help to reduce your tax burden and at the

same time, aim to grow your money

through equity investments. Who ca…

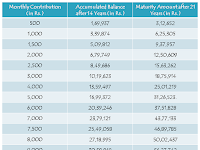

Sukanya Samriddhi Accounts interest 8.6%, Minimum Rs. 1,000, Maximum Rs. 1.5 lac Tax Rebate

Investment GuruSaturday, September 24, 2016Income Tax, News - SEPTEMBER 2016, Post Office Savings

No comments

Sukanya Samriddhi Accounts Rate of interest 8.6%

Per Annum(w.e.f 1-4-2016),calculated on yearly basis ,Yearly compounded. Minimum Rs. 1000/-and

Maximum Rs. 1,50,000 in a financial year. Subsequent deposit in multiple of Rs.

100 Deposits can be made in lump-sum No limit on num…

Kisan Vikas Patra – KVP - doubles in 9 years, Minimu Rs. 1000, No Maximum Limit, Tax Rebate

Investment GuruSaturday, September 24, 2016Income Tax, News - SEPTEMBER 2016, Post Office Savings

No comments

Kisan Vikas

Patra (KVP) Amount Invested doubles

in 110 months (9 years & 2 months) Available in

denominations of Rs 1,000, Rs 5000, Rs 10,000 and Rs 50,000. Minimum deposit Rs.

1000 and no maximum limit. Salient

features including Tax

Rebate o Certificate can be purchased b…

How to report Future and Options -F&O- trading in your Income Tax Return?

Investment GuruMonday, September 05, 2016Income Tax, Income Tax - E-filing, Income Tax - Filing, Share - Future and Options

No comments

How to report Future and Options (F&O) trading in your income tax (IT) return? Mr. Archit Gupta, Cleartax.in Income Taxpayers who deal in derivatives (example Future and Options ), describe their experience with the income tax filing process as vague and confusing. Here ar…

Capital Gain Account Scheme - 6 Smart Features

Capital

Gain Account Scheme - 6 Smart Features..! 1.

Capital Gain Account Scheme (CGAS) allows you to park sale proceeds

of a property without capital gains tax liability, provided another

property is bought within 2 years of sale or built within 3 years of

the sale. 2

. To…

New Online Fraud in the name of Income Tax Department

Investment GuruFriday, July 01, 2016Alerts - Income Tax, Income Tax, Income Tax - E-filing, Income Tax - Filing, JULY 2016

No comments

Hi All, new online

fraud. Today I received a mail where the

mail id is correct as admin. rf06@incometaxindiaefiling. gov.in .

The logo of income tax department

is also there. The mail states that I am

qualified for a refund of Rs. 25,882.19. It further states that in order …

Income Declaration Scheme 2016- Clarifications..!

Investment GuruWednesday, June 29, 2016Alerts - Income Tax, Income Tax, Income Tax - E-filing, Income Tax - Filing, June 2016, News - June 2016

No comments

Income Declaration Scheme 2016- Clarifications..! CBDT Circular No. 17/2016, Dated: May 20, 2016 [F.No.142/8/2016-TPL] (TPL DIVISION) The Income Declaration Scheme, 2016 (hereinafter referred to as ‘the Scheme’) incorporated as Chapter IX of the Finance Act, 2016 provides an …