Income Declaration Scheme 2016- FAQs..! The

Income Declaration Scheme, 2016 incorporated as Chapter IX of the Finance Act,

2016 is to come into force with effect from the 1 st of June,

2016. The first part of the Tax Payer Education

Series of Frequently Asked Questions (FAQs…

Showing posts with label Income Tax. Show all posts

Showing posts with label Income Tax. Show all posts

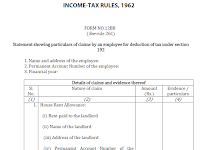

New Form to claim Tax Exemptions by Salaried Employees : Form 12BB

Investment GuruMonday, June 27, 2016Alerts - Income Tax, Income Tax, Income Tax - E-filing, Income Tax - Filing, June 2016, News - June 2015

No comments

New Form to claim Tax Exemptions by Salaried Employees : Form 12BB E mployers ask their employees to submit income tax

investment proofs along with LTA / HRA proofs. The

problem there is no standard format for the same. Each employer has different set of forms and asks for

dif…

Income Tax department to block PAN Number, LPG subsidy of wilful tax defaulters

Investment GuruTuesday, June 21, 2016Alerts - Income Tax, Banking Ombudsman, Income Tax, Income Tax - E-filing, Income Tax - Filing, June 2016

No comments

I ncome Tax department to block PAN Number, LPG subsidy of

wilful tax defaulters In order to cripple and check the activities of wilful tax

defaulters, the Income Tax (IT) department

has decided to “block” Permanent Account Number (PAN) of such entities, get

their LPG subsid…

Claiming Housing Loan Benefits in Income Tax Rreturn ..!

Investment GuruTuesday, June 21, 2016Alerts - Income Tax, Home Loan, Income Tax, Income Tax - E-filing, Income Tax - Filing, Income Tax - Home Loan

No comments

Claiming Housing Loan Benefits in IncomeTax Rreturn By Archit Gupta, ClearTax.in Buying

a home is India’s favourite dream. Buying property also involves making the

most of tax benefits. Increasingly, homes are being bought by the young with

home loans. If

you are unsure about …

5 Advantages and 5 Disadvantages of ELSS Tax Savings Fund

Investment GuruSunday, June 12, 2016Income Tax, Investment - Alerts, June 2016, Tax - Alerts, Tax Saving Investment - MF

No comments

5 Advantages Of ELSS Equity linked

savings scheme (ELSS) is one of the best

income tax saver scheme. It has following benefits. 1 . Investment

in the share market along with the income tax savings. 2. Maturity

amount and profit is also tax-free. 3. The lock

in period of 3 (three) …

COST INFLATION INDEX - CII- FOR FINANCIAL YEAR 2016-17 IS 1125

Investment GuruSunday, June 12, 2016Income Tax, MF - Capital Gains Tax, Real Estate - Capital Gains Tax, Real Estate - Investment, TAX - Capital Gains

No comments

CBDT

Notified Cost Inflation Index for F Y 2016-17 is 1125 The

Government of India, Ministry of Finance (Department of Revenue), Central Board

of Direct Taxes published in the Gazette of India, Extraordinary Notification No.

42 /2016/F.No.142/5/2016-TPL dated 02-06-2016 the …