Less than 1% of Income Tax Returns Scrutinised .. Who has ti IT File and Who Has to IT E- file? Central Govt ADVT

Showing posts with label Income Tax - E-filing. Show all posts

Showing posts with label Income Tax - E-filing. Show all posts

Mandatory to link AADHAAR with PAN from July 1, 2017 : CBDT

Investment GuruThursday, June 29, 2017Income Tax - E-filing, Income Tax - Filing, Investment - Documents

No comments

Mandatory to link AADHAAR with PAN from July 1, 2017 : CBDT The central government has made it mandatory for income taxpayers to link

their AADHAAR numbers with Permanent Account Numbers (PAN) from July 1, 2017. “Every person who has been allotted PAN as on July 1, 2017, and …

Mandatory Quoting of Aadhaar for PAN Applications & Filing Return of Income

Investment GuruMonday, April 10, 2017Income Tax - E-filing, Income Tax - Filing, Tax - E-filing, Tax - Filing

No comments

Mandatory Quoting of Aadhaar for PAN

Applications & Filing Return of Income Section 139AA of the Income-tax Act, 1961 as

introduced by the Finance Act, 2017 provides for mandatory quoting of Aadhaar /

Enrolment ID of Aadhaar application form, for filing of return of inc…

Are You Heavy On Investments? Income Tax Department Watching You

Investment GuruSaturday, March 25, 2017Alerts - Income Tax, Income Tax, Income Tax - E-filing, Tax - Filing

No comments

Are You Heavy On Investments? Income Tax Department Watching You..!

As on March 2017

SMS Alert on TDS to all Salaried Employees..!

Investment GuruTuesday, October 25, 2016Alerts - Income Tax, Income Tax, Income Tax - E-filing, Income Tax - Filing, OCT 2016

No comments

The Union Finance Minister Mr. Arun Jaitley said that better facilities and

services to the income taxpayers are the central to Direct Tax Reforms. He said, Te income tax

payers have a right to know the deductions made from their salary / income on

regular basis. More and mo…

How to report Future and Options -F&O- trading in your Income Tax Return?

Investment GuruMonday, September 05, 2016Income Tax, Income Tax - E-filing, Income Tax - Filing, Share - Future and Options

No comments

How to report Future and Options (F&O) trading in your income tax (IT) return? Mr. Archit Gupta, Cleartax.in Income Taxpayers who deal in derivatives (example Future and Options ), describe their experience with the income tax filing process as vague and confusing. Here ar…

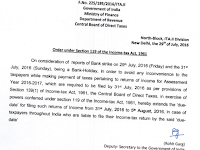

Due date for filing ITR for FY 2015-16, AY 2016- 2017 Extended to 5th August,2016

Investment GuruSaturday, July 30, 2016Income Tax - E-filing, Income Tax - Filing, JULY 2016

No comments

Due date for filing ITR for FY 2015-16, AY 2016- 2017 Extended to 5th August, 2016 As per provisions of Section 139(1) of Income-tax Act 1961, Central Board of Direct Taxes extends the due date for filing returns of Income for financial year 2015-16, Assessment Year 2016- 20…

Why you should file your income tax return by July 31, 2016

Investment GuruMonday, July 25, 2016Income Tax - E-filing, Income Tax - Filing, JULY 2016

No comments

Why you should file your income tax return

by July 31, 2016 While

you can file your personal income tax return even after the due date,

July 31, 2016 but you would lose certain benefits if you do so. The due date for filing income tax return

for individuals-July 31 - 2016 …

Five mistakes that delay your income tax re-fund

Investment GuruWednesday, July 13, 2016Alerts - Income Tax, Income Tax - E-filing, Income Tax - Filing, JULY 2016

No comments

Five mistakes that delay your income tax re-fund By Mr. Arjit Gupta , MyTaxCafe.com In the era of e-filing, small mistakes lead either to delayed or complete

denial of income tax refunds. So, avoid these 5 common mistakes that could lead

to delay in refunds. 1. Non e-filing of…

Federal Bank introduces Tax return e filing services

Federal Bank

introduces Tax return e filing services Federal Bank

has come out with a new initiative for its customers to e file their income tax

returns easily. For this, the Bank has launched a new portal service http://www.federalbank.co.in/clear-tax . Customers can login t…

How to efile Income Tax Return at incometaxindiaefiling.gov.in

Investment GuruThursday, July 07, 2016Income Tax - E-filing, Income Tax - Filing, JULY 2016

No comments

How to efile Income Tax Return at incometaxindiaefiling.gov.in Steps to efile your income tax return on income tax Department’s online tax filing site ( incometaxindiaefiling.gov.in ) are: Register yourself To e-file your income tax return, you will have you register on the i…

New Online Fraud in the name of Income Tax Department

Investment GuruFriday, July 01, 2016Alerts - Income Tax, Income Tax, Income Tax - E-filing, Income Tax - Filing, JULY 2016

No comments

Hi All, new online

fraud. Today I received a mail where the

mail id is correct as admin. rf06@incometaxindiaefiling. gov.in .

The logo of income tax department

is also there. The mail states that I am

qualified for a refund of Rs. 25,882.19. It further states that in order …

Income Declaration Scheme 2016- Clarifications..!

Investment GuruWednesday, June 29, 2016Alerts - Income Tax, Income Tax, Income Tax - E-filing, Income Tax - Filing, June 2016, News - June 2016

No comments

Income Declaration Scheme 2016- Clarifications..! CBDT Circular No. 17/2016, Dated: May 20, 2016 [F.No.142/8/2016-TPL] (TPL DIVISION) The Income Declaration Scheme, 2016 (hereinafter referred to as ‘the Scheme’) incorporated as Chapter IX of the Finance Act, 2016 provides an …