India : Age wise PAN card holders as on 31st March 2025

Investment - DocumentsIndia's PAN ( Permanent account Number ) growth between 2019 - 2025*. 🇮🇳Number of PAN holders in India reached to…

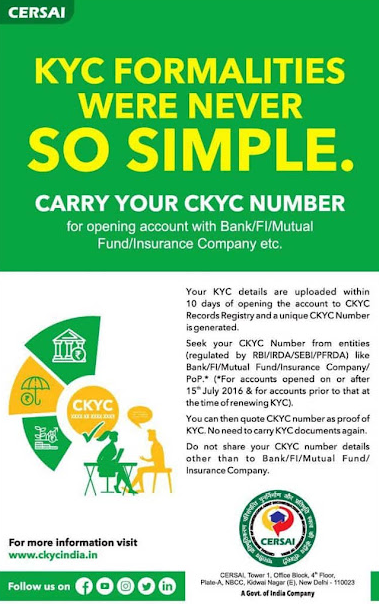

CKYC - CERSAI KYC Formaliites Were Never So Simple

Investment - DocumentsKYC Formalities Were Never So Simple CKYC - CERSAI

Urgent and important action required : Link Aadhaar with PAN

LOAN - DocumentsUrgent and important action required Recent amendments to the Indian Income Tax Rules makes it mandatory to link Aadh…

Transact Mutual Funds in DEMAT Form..!

Share Investment - DocumentsTransact Mutual Funds in DEMAT Form..! Can you buy Mutual Funds in DEMAT form? The answer is yes. It is not…

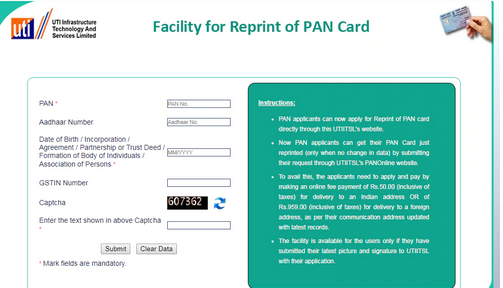

PAN card lost or damaged, Do not worry, just order a reprint for Rs. 50

Share Investment - DocumentsPAN card lost or damaged? Do not worry, just order a reprint for Rs. 50 With the 'Reprint PAN Card' servi…

The 18 transactions where quoting of PAN is mandatory

Share Investment - DocumentsThe 18 transactions where quoting of PAN is mandatory The transactions where quoting of PAN is mandatory is spe…

What Is A Demat Account & What Are Its Benefits?

VediosWhat Is A Demat Account & What Are Its Benefits? By Edelweiss Video Learn & Invest

PAN Card Tracking Procedure: How to check PAN Card Status

Real Estate - DocumentsPAN Card Tracking Procedure: How to check PAN Card Status What is a PAN card? A PAN (Permanent Account Number) is…

New PAN card norms with effect from 5 December 2018..!

NOV 2018New PAN card norms with effect from 5 December 2018..! In an attempt to prevent tax evasion, the Income Tax depart…

Aadhar Link Deadlines

Investment - DocumentsAadhar Link Deadlines Investment - Documents

Link PAN with Aadhaar by December 31, 2017

Investment - DocumentsLink PAN with Aadhaar by December 31, 2017 The government on August 31, 2017 extended the deadline for linking…

AADHAAR - PAN Linking Anomalies make filing I-T returns difficult

Investment - DocumentsAADHAAR - PAN Linking Anomalies make filing I-T returns difficult By Mr. Suresh Kumar, Deloitte Haskins and Sells …

Mandatory to link AADHAAR with PAN from July 1, 2017 : CBDT

Investment - DocumentsMandatory to link AADHAAR with PAN from July 1, 2017 : CBDT The central government has made it mandatory for incom…

No More Share Trading Without Aadhaar Card..

Share Investment - DocumentsNo More Share Trading Without Aadhaar Card.. National Securities Depository Limited (NSDL) has made it mandatory t…

Name Mis-match: How to link PAN Card with Aadhaar number

Investment - Documentslink PAN Card with Aadhaar number Linking of PAN card with Aadhaar card is easy when the name /date of birth /gend…

Aadhaar Card Needed everywhere

Investment - DocumentsAadhaar Card Needed everywhere FFrom Amul - Ab sab Ispar Aadhaarit?

Aadhaar card linking with PAN -if not done, the PAN becomes invalid.

Investment - DocumentsAadhaar card linking with PAN In the recent Finance bill amended in Lok Sabha, Aadhaar card number has to be li…

India - Aadhaar card issuance has touched 109 crore

Investment - DocumentsIndia - Aadhaar card issuance has touched 109 crore The Jan Dhan Yojna too seems to be gathering steam with more …

Quick way to manage your Personal Finance Documents

Share Investment - DocumentsQuick way to manage your Personal Finance Documents We all come across situations wherein our personal finances go …

Total Pageviews

Life Insurance

- Insurance - Two Wheeler

- Insurance - Motor

- Insurance - Online Term Plan

- Insurance - Property

- Insurance - Women

- Insurance - Alerts

- Insurance - Children

- Insurance - Critical illness

- Insurance - General

- Insurance - Home

- Insurance - Home Loan

- Insurance - IRDAI

- Insurance - Personal Accident

- Insurance - Property

- Insurance - Term Plan

- Insurance - Traditional Policy

- Insurance - Travel Policy

- Insurance - ULIP

- Insurance Agents

- Insurance Claims

- Life Insurance

- Life Insurance - Claims

- Life Insurance - Pension

Featured Post