NPS - National Pension Scheme Plan for your Retirement Integrated Enterprises (India) Pvt Ltd. For further details, please contact your nearest branch of Integrated.

For list of branches, please click here .

Showing posts with label Financial Plan - National Pension Scheme. Show all posts

Showing posts with label Financial Plan - National Pension Scheme. Show all posts

Midyear Tax Planning for 2019-20 - Moves to make now

Investment GuruSaturday, October 12, 2019Financial Plan - National Pension Scheme, Health insurance, OCT 2019, Tax Saving Investment - MF

No comments

Midyear Tax Planning for 2019-20 Moves to make now Income Tax Sections 80C, 80D, 80CCD (1B)

Retirement 5 Common Mistakes : Are You Making Same The Same Mistakes?

Investment GuruSunday, June 30, 2019Financial Plan - National Pension Scheme, Financial Plan - Retirement, JUNE 2019

No comments

Retirement 5 Common Mistakes Are You Making Same The Same Mistakes? S Manikandan, MBA, FChFP, CIS, AMFI, CII(London)

Managing Director - AISMONEY

No. 21, MBT Road

(Opp) Indian Bank

Walajapet - 632 513

Vellore Dt. TN, India. + 91 9840577675 manikandan@aismoney.com http://www.ai…

National Pension Scheme- NPS Sow at a young age to reap at ripe at age

Investment GuruFriday, September 28, 2018Financial Plan - National Pension Scheme, Financial Plan - Retirement, SEP 2018

No comments

National Pension Scheme- NPS Sow at a young age to reap at ripe at age Financial Plan - National Pension Scheme Financial Plan - Retirement,

Tamilnadu government contributory pension scheme

\ Tamilnadu government contributory pension scheme Financial Plan - National Pension Scheme

why Income Tax is levied on pension

Investment GuruSaturday, January 20, 2018Alerts - Income Tax, Financial Plan - National Pension Scheme, Income Tax, JAN 2018

No comments

All retiree members please initiate a

movement - every retired person after rendering 30 to 36 years of

service to the Govt or the Department where he worked and for all his

services the Dept. pay him/her salary which is of course treated as

income and is liable for inc…

How Reduce Income Tax Burden of Employees?

Investment GuruWednesday, October 18, 2017Alerts - Income Tax, Financial Plan - National Pension Scheme, Income Tax, OCT 2017

No comments

How Reduce Income Tax Burden of Employees? by Mr. RP Yadav, Genius Consultants For any company, the real assets are its

employees. While companies reward their hard working employees every year, they

must pay attention to the compensation structure being offered. A higher pac…

Retirement Planning ,Starting early is not a choice, it is a must

Investment GuruSunday, October 15, 2017Financial Plan - National Pension Scheme, Financial Plan - Retirement, Financial Planning, OCT 2017

No comments

Retirement Planning , Starting early is not a choice,

it is a must By Mr. Jose John, Max Life Insurance India is often

called a young country. As per the current predictions India’s youth population

(15-29 years) is going to cross 45 crore by 2021. Thus by 2020 India is all set…

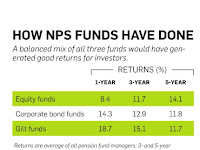

Returns on National Pension System NPS

Returns on National Pension System NPS Equity Funds Govt Bond Fund Tier 1 Account Corporate Debt Fund Tier 1 Account As on May 2017

Early Withdrawal from National Pension System- NPS will be Tax-Free - 25% OF CORPUS CAN BE TAKEN OUT..!

Investment GuruThursday, February 02, 2017Budget 2017 - 18, Financial Plan - National Pension Scheme

No comments

Early

Withdrawal from National Pension System- NPS will be Tax-Free - 25% OF CORPUS

CAN BE TAKEN OUT..! Mr. Narendra Nathan, ET Early withdrawals from

the National Pension System (NPS) will not attract tax, the Budget has

clarified, and experts suggest using this route to inc…

Budget 2017 - 18: Two Changes to National Pension System - NPS..!

Investment GuruThursday, February 02, 2017Budget 2017 - 18, Financial Plan - National Pension Scheme

No comments

Budget 2017 - 18: Changes to National Pension System (NPS) Budget 2017-18 has proposed two changes to the national pension system. No, it not what you are looking for!! Change I: A subscriber whose NPS account is at least 10 years old will be eligible for withdrawing 25% of h…

Get additional income tax benefit of Rs. 50,000 in National Pension Scheme - NPS

Get additional income tax benefit of Rs. 50,000 in

the National Pension Scheme (NPS) under section 80CCD (1B) above limit of 80CCE.

Open New Pension Account use Aadhaar eKYC..!

Investment GuruFriday, December 23, 2016Financial Plan - National Pension Scheme, Terminology - Finance, Terminology - Financial Planning

No comments

Open New Pension Account use Aadhaar

eKYC..! E-authentication technique using Aadhaar eKYC services is legally valid

authentication. E-authentication technique using Aadhaar eKYC services is

legally valid authentication. New subscribers of National Pension System (NPS)

will n…

You Need to invest More for Retirement..!

Investment GuruMonday, August 01, 2016Financial Plan - National Pension Scheme, Financial Plan - Retirement

No comments

You

Need to invest More for Retirement by

Mr. DHIRENDRA KUMAR, Value Research The

basic numbers of saving / investing, life expectancy of people have

changed If

you want your savings to be worth more, then you should invest more. Long-term

projections Over

the last few months…

NPS Mobile App – View Statement ..!

NPS Mobile App – View Statement ..! NSDL recently launched NPS Mobile App to access NPS (New Pension Scheme) account. 8 Major Features of NPS Mobile App

(1) . View current Holdings 2. Request for Transaction Statement for the year on e mail ID. 3. Change contact details like Te…

Smart ways to Invest for Secured Retirement Corpus..!

Investment GuruSaturday, April 30, 2016Financial Plan - National Pension Scheme, Financial Plan - Retirement, Life Insurance - Pension

No comments

Smart ways to Invest for Secured

Retirement Corpus..! In order to accumulate wealth for

retirement, an individual must focus on both saving and long-term investing. In order to accumulate wealth for

retirement, an individual must focus on both saving & long-term investing…

Employees' Provident Fund or National Pension Scheme : Which Can Benefit You More..?

Investment GuruSunday, March 20, 2016Financial Plan - National Pension Scheme, Financial Plan - Retirement, Provident Fund

No comments

Retirement benefits have assumed importance in

the falling interest rate scenario. In India, there are 2 such schemes: Employees' Provident Fund (EPF) scheme and the

National Pension Scheme (NPS). A recent proposal by the government to tax the

final proceeds of EPF at th…