SIRC of the Institute of Cost Accountants of India cordially invites u for the FREE Program on DIRECTORS & MEETINGS UNDER THE COMPANIES ACT 2013 ( AGM, EGM & BOARD) on Friday 10th February from 5 PM to 7.30 PM at CMA Bhawan, Montieth Lane, Egmore, Chennai 600 008…

RBI Rate Hike As Expected, May Further Impact Affordable Housing Demand by Anuj Puri, Chairman – ANAROCK Group

RBI Rate Hike As Expected, May Further Impact Affordable Housing Demandu Anuj Puri, Chairman – ANAROCK Group The 25 bps rate hike is much along the expected lines. With repo rates now at 6.5%, there could be some repercussions on housing uptake as home loan interest rat…

Reserve Bank of India has hiked the key interest rate by 0.25% to 6.50%.

The Reserve Bank of India (RBI) has hiked the key interest rate by 25 basis points (0.25%) to 6.50%. This is in line with the street expectations. It is the RBI's sixth consecutive rate hike this year to combat rising prices. The RBI slowed the pace of hikes as the inflat…

HCC Conducts the programme on MASTER HEALTH CHECK UP FOR MSMEs on IT

HCC Conducts the programme on "MASTER HEALTH CHECK UP FOR MSMEs on IT" on Friday, the 10th February 2023 at 6.00 pm at Chamber Premises, Greams Road, Chennai. Please register using the link given below: http://bitly.ws/zDum For HCC Members: Rs 199 +18 % GST For Non M…

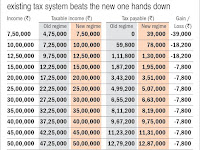

Good positive budget 2023-24

Good positive budget 1) For senior citizens schemes, Investments hiked to 30 lakhs from 15 lakhs- 2) High end tax payers( from 43% to 39%) 3) No tax for income upto 7 lacs in new tax regime. *Much awaited Big news to salaried class* 4) Post office POMIS increased from 4.5 lakh…

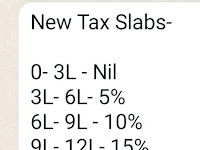

Rebate Limit to increase to 7 Lakhs in New tax regime 2023-24

Rebate Limit to increase to 7 Lakhs in New tax regime 2023-24 New Tax Slabs- 0- 3L - Nil 3L- 6L- 5% 6L- 9L - 10% 9L- 12L- 15% 12L- 15L- 20% Above 15L - 30% [2/1, 12:31 PM] Mithun Share Investment: Highest Surcharge Rate Reduced from 37% to 25%

Share investment & Trade; India has successfully managed the transition to T+1 settlement. ..

India has successfully managed the transition to T+1 settlement. If shares are sold on Monday (day T), the sale proceeds are credited to the bank account of investor after midnight of Tuesday (day T+1). The funds are available to the investor from early Wednesday. Similarly,…

Family Budget vs Country Budget

Family Budget vs Country Budget February 1st is the central budget.*Central budget has only short term impact on your wealth* *Your family budget has long term impact on your wealth*. Earmark one such day for family budget, which has fundamental value N Vijay Kumar, MD, www.clic…