Indian Mutual Fund Industry Clipping at 20-25%

CAGR till 2020 - New AMFI Chief NS Venkatesh Veteran banker and bond market specialist NS Venkatesh,

who took over as the AMFI (Association of Mutual Funds in India ) chief late

last month, expects the industry to continue to g…

SBI cuts interest rates to 8.30% for Housing Loans

SBI cuts interest rates to

8.30% for home loans The State Bank of India (SBI) on

Thursday announced a reduction in interest rates on home and automobile loans

by 0.05% (five basis points - bps). The rates will be 8.30% for home loans

up to Rs 30 lakh - the lowest in the indus…

New Real Estate Projects Need to Show RERA Registration Number..!

New Real Estate Projects Need to Show RERA Registration Number..! by Mr. SHVETA JAIN, MD, Real

Estate Private Wealth Services Since now RERA is implemented and regulators are already

in place, am I assured of timely delivery and covered against

misrepresentation? Can I ask a …

Mutual Funds and Income Tax Savings

Investment GuruSaturday, November 04, 2017Income Tax - Investments, NOV 2017, Tax Saving Investment - MF

No comments

Mutual Funds and

Income Tax Saving Tricks.. by Mr. DHIRENDRA KUMAR, Value Research About a month ago, in a sister

publication of ET, I wrote a column explaining the exact nature of the tax

advantage that mutual fund investments offered over bank fixed deposits. The case I …

Quantum Multi Asset Mutual Fund - One Fund that Combines 3 different Asset Classes

Investment GuruSaturday, November 04, 2017GOLD - ETFs, Gold Investment, MF - Debt Funds, Mutual Funds - Equity, NOV 2017, OCT 2017

No comments

Quantum Multi Asset Mutual Fund - One Fund that Combines 3 different Asset Classes Investment Details Return since Launch: 10.47% Minimum Investment ( R ) 500 Minimum Addl Investment ( R ) 500 Minimum SIP Investment ( R ) 500 Minimum No of Cheques 6 Minimum Withdrawal ( R ) 500 Minimum Balance ( R …

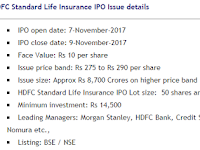

HDFC Standard Life Insurance IPO: Should you invest?

HDFC Standard Life Insurance IPO: Should you invest? by Mr. Suresh KP HDFC

Standard Life Insurance IPO - Should you invest? Mumbai

based, HDFC Standard Life Insurance IPO would open for subscription on 7th

November, 2017. HDFC

Standard Life Insurance Ltd is the third largest…

ANAROCK Report ‘Mumbai Redefined’ Launched at Economic Times’ ACETECH

ANAROCK

Report ‘Mumbai Redefined’ Launched at Economic Times’ ACETECH Maximum City's real estate triumphs,

tribulations and opportunities on the road to future-readiness ANAROCK

Property Consultants today released its research report ‘ Mumbai Redefined ’ in

association wit…

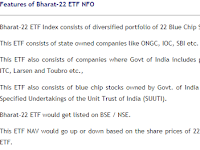

Bharat-22 ETF NFO Open on 15th November, 2017 : Should you invest?

Investment GuruThursday, November 02, 2017Mutual Fund - ETFs, NOV 2017, OCT 2017, Share - ETFs

No comments

Bharat-22 ETF NFO Open on 15th

November, 2017 : Should you invest? by Suresh KP Bharat-22

ETF NFO Review - Should you invest? Finally, Bharat-22 ETF New Fund Offer (NFO)

would open for subscription on 14th November, 2017 for Anchor

Investors. For Retail investors, Bharat-22…