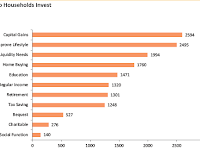

Why do Indian Households Invest? Top 11 Reasons..! Form SEBI Investor Survey 2015 1. Capital Gains 2594 2. Improve Lifestyle 2495 3. Liquidity Needs 1994 4. Home Buying 1760 5. Education 1471 6. Regular Income 1320 7. Retirement 1301 8. Tax Saving 1248 9. Bequest 527 10. Char…

Indian’s Investments & Savings - Awareness & Preferences..!

Indian’s Investments & Savings -

Awareness & Preferences..! Form SEBI Investor Survey 2015 W hile a

significant portion of this survey focuses primarily on investors, the current

section attempts to analyse the awareness of financial and non- financial

instruments – …

The Indian Share Market & Real GDP Relationship..!

The Indian Share Market & Real GDP Relationship..! From SEBI Investor Survey 2015 (SIS 2015) Significant component of the SIS 2015 is to collect and

analyse data on investor perceptions and sentiments. To gauge the relationship

between stock markets and economic growth, …

CREDAI Hyderabad checks into a new Office

CREDAI

Hyderabad checks into a new Office CREDAI Hyderabad checks

into a new Office The new office to have dedicated space

to focus on Skill Development for members and their technical and marketing

work force for enhancing efficiency & effectiveness Hyderabad 28 th May201…

Indian and Global Share Markets: A Comparative Evaluation..!

Indian and Global Share Markets: A Comparative Evaluation..! From SEBI Investor Survey 2015 (SIS 2015) The Indian equity market has grown in size and value

since the economic liberalization in 1991. Despite the post- Global Financial Crisis (GFC) muted

global growth, there h…

Indian Financial Markets: Primary Drivers - Urbanization and Socio Economic growth

Indian Financial Markets: Primary Drivers - Urbanization

and socio economic growth Form SEBI Investor Survey 2015 Urbanization and socio economic growth are two

interconnected significant drivers, which are expected to drive investment

growth and an increased penetration in …