Sukanya Samriddhi Accounts Rate of interest 8.6%

Per Annum(w.e.f 1-4-2016),calculated on yearly basis ,Yearly compounded. Minimum Rs. 1000/-and

Maximum Rs. 1,50,000 in a financial year. Subsequent deposit in multiple of Rs.

100 Deposits can be made in lump-sum No limit on num…

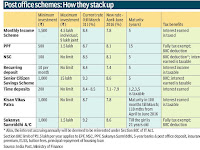

Kisan Vikas Patra – KVP - doubles in 9 years, Minimu Rs. 1000, No Maximum Limit, Tax Rebate

Investment GuruSaturday, September 24, 2016Income Tax, News - SEPTEMBER 2016, Post Office Savings

No comments

Kisan Vikas

Patra (KVP) Amount Invested doubles

in 110 months (9 years & 2 months) Available in

denominations of Rs 1,000, Rs 5000, Rs 10,000 and Rs 50,000. Minimum deposit Rs.

1000 and no maximum limit. Salient

features including Tax

Rebate o Certificate can be purchased b…

National Savings Certificates (NSC) Tax Rebate 5 Years Minimum Rs. 100, 8.1%

National

Savings Certificates (NSC) 5 Years

National Savings Certificate (VIII Issue) From

1.4.2016, interest rates are as follows:- o 8.1% compounded six monthly but payable at maturity. Rs. 100/- grows to Rs 147.61 after 5 years. Minimum R. 100 No

maximum limit available in de…

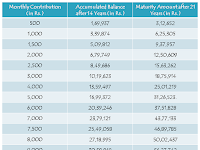

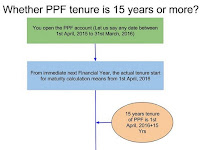

15 year Public Provident Fund Account – PPF - 8.10%, Minimum Rs. 500, Maximum Rs. 1,50,000 - Tax Rebate

15 year Public Provident Fund Account PPF Interest payable,

Rates,

Periodicity etc. From

1.4.2016, interest rates are as follows:- o 8.10% per annum (compounded yearly). o Minimum Amount

for opening of account and maximum balance that can be retained Minimum Rs. 500, Maximum Rs.

…

Senior Citizen Savings Scheme - SCSS - 8.6% - Deposit multiple of Rs.1,000, Maximum Rs. 15 lakh, Income Tax Benefit

Senior Citizen Savings Scheme (SCSS) Interest payable,

Rates,

Periodicity etc. From

1.4.2016, interest rates are as follows:- o 8.6% per annum, payable from the date of

deposit of 31st March/30th Sept/31st December in the first instance &

thereafter, interest shall be payab…

Post Office Monthly Income Scheme Account - MIS -7.80%, In multiples of Rs. 1500

Post Office Monthly Income Scheme Account (MIS) Interest payable, Rates, Periodicity etc. From 1.4.2016, interest rates are as follows:- o 7.80% per annum payable monthly. o Minimum Amount for opening of account and maximum balance that can be retained o In multiples of Rs 1500/- o Ma…

Post Office Time Deposit Account 5 year - 7.9%, Tax Rebate Minimum Rs. 200

Post Office Time Deposit Account (TD) I nterest payable,

Rates, Periodicity etc. Interest

payable annually but calculated quarterly. From 1.4.2016, interest rates are as follows:- Period Rate 1 year Account 7.1% 2 year Account 7.2% 3 year Account 7.4% 5 year Account 7.9% Minimum Amount

fo…