Unit Linked Pension Plans - ULPPs (1) Insurance companies offer unit

linked pension plans, which are market linked products, specifically designed

for investors looking for retirement planning products. (2) Investors have a choice about the asset

allocation of the fund they …

Non-resident Indian bank account opening from overseas

Non-resident Indian bank account opening from

overseas Non-resident Indians (NRIs) are allowed to open

Non Resident (External) Accounts (NRE Account) and Non Resident Ordinary

Accounts to open savings account / or fixed deposits with banks in India. However, since many NRIs …

Credit Risk and Investments..!

Investment GuruSunday, March 20, 2016Investment - Alerts, Mutual Funds - Alerts, News - March 2016, Share Market - Alerts

No comments

Credit Risk and Investments..! By Ms. UMA SHASHIKANT, CIEL Whether it's on the stock exchange, in a bank or

in a debt fund, credit risks are everywhere. Care and diligence can go a long way in

mitigating them Credit risk is a big deal these days. While being rightly en rag…

Employees' Provident Fund or National Pension Scheme : Which Can Benefit You More..?

Investment GuruSunday, March 20, 2016Financial Plan - National Pension Scheme, Financial Plan - Retirement, Provident Fund

No comments

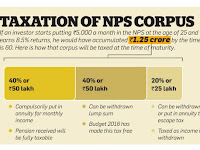

Retirement benefits have assumed importance in

the falling interest rate scenario. In India, there are 2 such schemes: Employees' Provident Fund (EPF) scheme and the

National Pension Scheme (NPS). A recent proposal by the government to tax the

final proceeds of EPF at th…

Insurance Coverage Against Loans..!

Coverage Against Loans..! Those seeking loans to buy a

home or a car now have access to a larger suit of life and general insurance

products, which offer insurance cover against unemployment, critical illness,

personal accident, etc - factors that could affect their ability …

ZERODHA LAUNCHES INDIA’S FIRST TAMIL LANGUAGE TRADING PLATFORM ‘KITE’

ZERODHA

LAUNCHES INDIA’S FIRST TAMIL LANGUAGE TRADING PLATFORM ‘KITE’ - ANNOUNCES

ZERO BROKERAGE AND MUTUAL FUND BUSINESS - ZERODHA , India’s leading online brokerage firm, today announces

the launch of its web based TAMIL language

trading portal KITE

and also ZERO

brokerage…

Mr. Satyan Jambunathan, Chief Actuary – ICICI Pru Life

Mr. Satyan Jambunathan, Chief Actuary – ICICI

Pru Life Mr. Satyan Jambunathan Chief

Actuary – ICICI Prudential Life Insurance Company Limited Mr. Satyan Jambunathan is Chief Actuary at ICICI Prudential Life

Insurance Company Limited, having responsibility for the Actuarial, …

Public Provident Fund Rate Cut: Positive for Bonds and Bond Funds..!

Investment GuruSaturday, March 19, 2016Bonds, Financial Plan - Retirement, Provident Fund, Tax Free Bonds

No comments

Public

Provident Fund Rate Cut: Positive for

Bonds and Bond Funds..! The central government has cut rates on

Public Provident Fund (PPF) from 8.7% to 8.1% & Kisan Vikas Patra from

8.7%to 7.8%. The sharp cut in PPF rates will pull down

government bond yields sharply as …

National Pension System and Provident Fund should get Same Income Tax Benefits..!

National Pension System and Provident Fund should get Same Income Tax Benefits by Mr. Harsh Roongta, Registered Investment Advisor Much has

already been written about the proposal to tax 60 per cent of the Employees'

Provident Fund (EPF) corpus on retirement and the subs…