Mutual Fund Investment: What is NAV? by FundsIndia.com, Mutual Fund

Research Desk Ever wondered what all that jargon

in fund factsheets or application forms or articles on investments mean? To

make it easier to understand the world of investing, we are starting a weekly

colum…

Showing posts with label Terminology - Mutual Fund. Show all posts

Showing posts with label Terminology - Mutual Fund. Show all posts

Mutual Fund Investment: What is a credit rating?

Investment GuruSunday, September 20, 2015News - SEPTEMBER 2015, Terminology - Mutual Fund

No comments

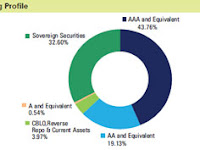

Rating organisations

like evaluate the credit worthiness of

an issuer with respect to its ability to

pay back debt over the specified period of time. The rating is given

as an alphanumeric code that represents a graded structure or creditworthiness. T he Indian

credit rating in…

Abbreviations Used in Mutual Fund

List

of Abbreviations Used in Mutual Fund.. Terminology - Mutual Fund.. Abbreviation - Full Form AMC

Asset Management Company AMFI

Association of Mutual Funds in India ATM

Automatic Teller Machine AUM

Assets Under Management BRICS

Brazil, Russia, India, China, South Africa CAGR

Com…

Terminology - Mutual Fund : Debt Mutual Funds

Terminology - Mutual Fund : Debt Mutual Funds..

Debt mutual funds specifically invest in debt securities,

Example government securities, hold less risk and promise a steady income.

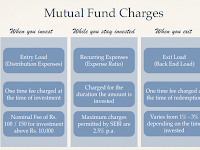

Mutual Fund Exit Load..!

by

Mr. Srikanth Meenakshi, Founder and Director,

FundsIndia.com Exit load is a charge levied by the

mutual fund house at the time of redeeming a mutual fund investment. It is

typically expressed as a percentage of the redemption amount depending on the

number of days an inves…

Terminology Closed -Ended Mutual Funds

Closed -Ended Mutual Fund Schemes by Mr. Niranjan

Risbood, Director Manager Research, Morningstar India Closed - ended mutual

fund schemes give the fund manager the confidence to invest, without the fear

of redemptions in between. As a result, he can

take a long-term call on…

Terminology - Mutual Fund - Risk Factors

Mutual Fund General

Risk Factors: Mutual Fund

Investments are subject to market risks, read all scheme related documents

carefully. Past performance may

or may not be sustained in the future. All the equity

schemes fall under the “High Risk” as per product label categorizati…

Terminology - Mutual Fund - Arbitrage Mutual Fund ..

An arbitrage mutual fund

is an open - ended equity scheme that aims to generate capital appreciation &

income by predominantly investing in arbitrage opportunities in the cash &

derivatives segment (Future and options – F & O) of the equity market &

investin…

What is Arbitrage Mutual Funds?

by Mr. Brijesh Damodaran, Zeus WealthWays LLP The

last few weeks have seen a new buzz in the mutual fund (MF) space, with fund

houses promoting arbitrage funds & investors lapping it up. These funds

have always been in the investment basket, but never at the forefront as…

Consumption Mutual Funds Outperforming..

Consumption mutual

funds, which have been outperforming the broader indices over the last 5 years,

have increased exposure to companies s beyond the fast-moving consumer goods,

or / FMCG, sector. The portfolios of UTI Lifestyle, Birla Sun Life GenNext,

Birla Sun Life Buy In…

Multi Asset Mutual Funds

Terminology - Mutual Fund The

traditional types of multi asset funds are balanced funds & monthly income

funds, which invest only in 2 assets-equity and debt. The newer

ones offer exposure to more assets. So, in

India, to cash in on the rally in gold, a few mutual fund h…

Mutual Fund: Benefits of Dividend option..

The

key benefit of investing via the mutual fund (MF) dividend option is that it

can provide as a source of income which can help in planning expenses better.

Additionally, there is the incoem tax efficiency of returns. The

dividend option is beneficial for short-term debt f…

Mutual Fund: Dividend Distribution Tax..

At

the time of distributing a dividend, the mutual fund (MF) Asset Management

Company (AMC) is required to pay a dividend distribution tax (DDT). Therefore,

even though your AMC has declared a dividend of Rs. 10, you may receive a

smaller amount owing to the deduction of DD…

Terminology - Mutual Fund: Ex-date..

Mutual Fund: Ex-date..

The day after the record date is known as ex-date or / ex-dividend. On ex-date, the NAV (Net Asset Value) the scheme is adjusted according to the dividend declared.

If the NAV on the record date i.e., May 14 is Rs. 16, the price will fall by Rs. 2 (ex…

Mutual Fund: Record Date..

Record

date is the date on which the list of mutual fund (MF) unit holders who are

eligible to receive dividends is populated. The unit holders, whose names

figure in the books on the record date, will be considered for dividend

distribution. Dividend

is declared on the face…

Mutual Fund : Dividend & Growth Options..

Mutual

fund (MF) investors always have the option to choose between Growth and

Dividend Options (plans). The choice boils down to whether or / not you want intermittent cash flows from

your investments or / whether you want the cash to accumulate. The

dividend option of an…