Income Tax Exemption To Invest in ELSS Mutual

Fund or Not? With FY16 coming close to an end, in vestors looking

to save tax under sec tion 80C of the IT act, could consider equity linked

savings schemes (ELSS) amongst other funds for investment. 1. What is ELSS? ELSS is a type…

Showing posts with label Tax Saving Investment - MF. Show all posts

Showing posts with label Tax Saving Investment - MF. Show all posts

FY 2015-16 INDIAN INCOME TAX PROVISIONS AT A GLANCE...!

Investment GuruSaturday, February 27, 2016Alerts - Income Tax, Income Tax, Tax Saving Investment - MF

No comments

INCOME TAX PROVISIONS AT A GLANCE.. * As per Indian Income Tax Act, Income is taxable under five (5) heads- 1. Salary 2. House Property 3. Business or / Profession 4. Capital Gain and 5. Other Sources. * Salaried person must obtain Form 16 from his Employer Every Year. * Income…

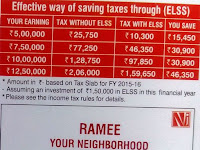

ELSS Save Up to Rs. 46350 Every Year

Investment GuruSaturday, February 13, 2016Alerts - Income Tax, Income Tax, NEWS - Feb 2016, Tax Saving Investment - MF

No comments

ELSS Save Up to Rs. 46350 Every Year

For More Details S.Ramalingam Financial Advisor Senior Advisor - General, Health, Life & Mutual Funds, 12 /5 Jaya Apartments, Jayaram Avenue, Sastri Nagar, Adyar, Chennai-600 020 Mobile : 98844 95696, 9840147301 E mail id :ssramee@gmail.c…

Tax Saving Investment Planning for 2015-16 Financial Year

Investment GuruSunday, January 31, 2016Income Tax, Income Tax - Investments, News - January 2016, Tax Saving Investment - MF

No comments

Tax Saving Investment Planning for 2015-16 Financial Year With the financial year 2015-16, taxpayers to focus on their income tax

planning. Section 80 of the Income Tax Act, 1961 provides several beneficial

ways through which taxpayers can reduce their tax liabilities. Here a…

To avail income tax benefits under section 80C for Rs. 1.5 lac

Investment GuruThursday, January 28, 2016Alerts - Income Tax, Income Tax, Tax Saving Investment - MF

No comments

To avail income tax benefits under section 80C for Rs. 1,50,000 We are coming to financial year 2015-16 closure soon. To avail tax benefits under section 80C for Rs. 1,50,000, you should complete the tax saving investments before March end. ELSS (Equity Linked Savings Schem…

ICICI Pru.Long term Equity Fund: Save Income Tax Up to Rs.46,350

Investment GuruMonday, January 25, 2016Alerts - Income Tax, Income Tax, News - January 2016, Tax Saving Investment - MF

No comments

ICICI

Prudential Long term Equity Fund: Save Income Tax Up to Rs.46,350 Invest

in ICICI Prudential Long term Equity Fund (Tax Saving) and save up to

Rs.46,350*; The

increase in the investment limit under section 80C of Income Tax Act, 1961 now

allows you to take deduction up…

How to Save Income Taxes & Reap High Returns Instead!

How to Save Taxes & Reap High Returns Instead..! ELSS or Tax Saving Mutual Funds Simply put, ELSS is a type of diversified equity mutual fund, which qualifies for tax exemption under section 80C of the Income Tax Act. If you are wondering, ELSS stands for Equity Linked Sa…