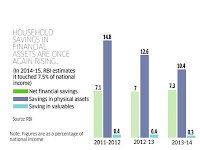

India- House Hold Savings in Financial Assets are Once Again Rising

As on December 2015

Showing posts with label Savings. Show all posts

Showing posts with label Savings. Show all posts

I saving is Rs.5,000 per month. Please say good retirement Plan?

Investment GuruMonday, April 20, 2015Mutual Funds - Equity, Savings, Tax Saving Investment - MF

No comments

Assuming

your expenses now is Rs. 30,000 per month. At 6 % inflation, 24 years

from now (2039), you need about Rs.1.25 lacs per month. This works

out to Rs.15 lacs per month. Assuming

you would earn 8% return on investment then, you need a corpus of

Rs.1.90 crores in 2039. …

India's Household Financial Saving Rate 7% only..

India's Household Financial Saving

Rate 7 per cent only.. Reserve Bank of India's (RBI) annual

report shows that household financial saving rate has declined sharply from 12%

in 2009-10 to 7.1% in 2012-13 - clearly, people do not have enough financial

savings. Here f…

India's National Savings Rate 30%

According to the

global financial services major, a recovery in growth could bring more than USD

1 trillion in extra household savings into the financial system over the next 5

years. “The Prime Minister’s

ambitious plans for growth & prosperity thus hinge on India’s abi…

ICICI Bank : Advantage Woman Savings Account..!

Benefits of Advantage Woman Savings Account

India's largest Private sector bank ICICI Bank Advantage Woman Account enables today’s independent women to enjoy hassle-free banking services. Besides the core ICICI Bank advantage, the Advantage Woman Savings Account is pack…

ICICI Bank: Online Flexible RD..!

India's private sector banking major ICICI Bank on recently launched iWish , an online RD ( recurring deposit) product targetted primarily at young depositors. The bank's savings account holders can book this variable RD by logging on to their Internet banking account…

Indian Household Savings Decline to 22.3 % in 2011-12: RBI survey

While financial savings rate fell, physical saving rate rose as households turned to physical assets as inflation hedge The Reserve Bank of India (RBI) on recently expressed concern over steadily falling savings & investment rates, especially the financial savings by ho…

Indian's Deposits and Savings Style..!

Bank Deposits still about 50% of India's total financial Savings..! Details Per Centage Bank Deposits 49.8% Life Insurance 19.9% Currency 10.7 Providend Fund, Pension 10.3% Shares and Mutual Funds , Debentures 4.3% Other Savings 4.9% Src: Reserve B…

Savings and Investment Driver of Growth

By Mr. Ajay Srinivasan, Chief Executive, Aditya Birla Management Corporation Four years (2008) after the worst financial crisis in recent times, the economic situation in India continues to slip. A couple of months ago, India posted the lowest GDP (Gross Domestic Production)…

Savings Bank Account number Portability Coming

The finance ministry is working on savings banks account number portability, which will allow a customer to retain his account number while changing his bank. Mr. D.K Mittal, Financial Services Secretary, “We want to do savings account number portability) Right now there are…

PPF Better Returns

Central government notified increase in interest rates on PPF (Public Provident Fund) to 8.6% from 8% now, and also raised ceiling on annual contributions to the fund to Rs. 1 lakh from Rs. 70,000. Interest rates on savings account in post offices would also go up to 4% fro…

Post Office Small savings Rates Hiked

The Post Office small saving schemes have been restructured on the basis of the recommendations of the Shyamala Gopinath Committee, which submitted its report in June, 2011. Interest rates on postal small savings have been hiked in the range of 4% up to 8.6%. The investment …

Seventy percent of Indian household savings not exposed to equities: McKinsey Report

Consultancy firm McKinsey says 70% of Indian household savings not exposed to equities Mr. Naveen Tahilyani Partner, McKinsey said "Savings in gold is not productive as it doesn't flow into the financial system and are purely for returns." According to McKinsey…

Religare Finvest: Raise Rs. 800 crores NCDs

Religare Finvest Limited (RFL), a systemically important non-deposit accepting Non-Banking Finance Company (NBFC) and a wholly owned subsidiary of Religare Enterprises Limited (REL), proposes to raise upto Rs. 800 crores (including base issue size upto Rs.400 crores with an…

India's household savings Hit 13 year Low

According to the annual report of the RBI (Rerseve Bank of India), Indians are saving less and borrowing more. The financial savings of an Indian household sector has moderated to 9.7% of GDP in 2010-11 from 12.1% in 2009-10, This was reflected in lower growth in their bank …

Muthoot NCD Rs. 1,000 Cr issue to open on Aug 23

The non-convertible debentures (NCD) issue of Muthoot Finance Ltd (MFL) open today (August 23, 2011). The company raise Rs. 1,000 crore through the public issue of debentures. The NCD issue, with 3 investment options and an effective yield of up to 12.25% per year closes o…