Paying Tax on Capital Gains.. By CIEL Capital gains accrue

when an investor sells an asset (Property, Shares, Mutual Fund Units) for profit. The income tax (IT) laws define

capital assets and mandate that investors pay the applicable tax on shorter

long-term gains. The h…

Showing posts with label Real Estate - Capital Gains Tax. Show all posts

Showing posts with label Real Estate - Capital Gains Tax. Show all posts

Income Tax and CAPITAL GAINS..

Investment GuruTuesday, August 19, 2014Income Tax, MF - Capital Gains Tax, Real Estate - Capital Gains Tax, Share - TAX

No comments

Income Tax and CAPITAL GAINS.. Profits

and gains arising from transfer of a capital asset (Property, Stocks, Mutual Funds, Gold, Silver etc) are chargeable to income tax

under the head, Capital Gains (Sections 45 to 55A)*. Capital

gains can be divided in 2 categories i.e. s…

A Tax Reality check for New House Buyers

by Mr. Amarpal

Chadha, Tax Partner, EY. . The buyer has to

deduct tax on payment of sale consideration or credit to account of seller,

whichever is earlier. If you are planning

to buy a house or paying for an under-construction property, you should be

aware of a very importan…

Budget 2014-15: Capital Gain Benefits for One Residential House in India..!

Budget 2014-15 – Implications :

One Residential House in India..! This 2014-15 budget has plugged various

judicial pronouncements on the interpretation of the word “a residential house”

which was decided as “any” and / or “many” residential houses. Now this Budget has finall…

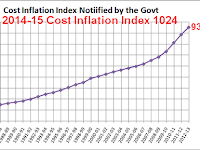

2014-15: Cost inflation index raised by 9.05%

Investment GuruMonday, June 16, 2014MF - Capital Gains Tax, Real Estate - Capital Gains Tax, Share - TAX

No comments

In the 2013-14 year

the cost inflation index increased 10.2% The Central Board of

Direct Taxes (CBDT) has specified a value for the cost inflation index for

2014-15. A cost inflation

index helps reduce the inflationary gains, thereby reducing the long-term

capital gains tax …

Cost inflation Index for Financial Year 1981- 82 to 2014 - 15..

Investment GuruSaturday, June 14, 2014MF - Capital Gains Tax, Real Estate - Capital Gains Tax, Share - TAX, TAX, TAX - Capital Gains

No comments

Cost

Inflation Index (CII) for Financial Year

1981 - 82 ( Base Year) to 2014 - 15 is given below

for your reference. Financial Year

Cost Inflation Index 1981

- 82 100 1982

- 83 109 1983

- 84 116 1984

- 85 …

Cost Inflation Index : Financial Year 2014-15 is 1024

Central

Board of Direct Taxes (CBDT) has notified the Cost Inflation Index (CII) for

Financial Year 2014-15. Complete

Notification is Given Below. SECTION

48, EXPLANATION (v) OF THE INCOME-TAX ACT, 1961 - CAPITAL GAINS - COMPUTATION

OF - NOTIFIED COST INFLATION INDEX FOR FINA…

Income Tax is withheld at 20 % if property seller does not have PAN

This is a new

provision, which has been introduced with effect from 1 June 2013 Reply by

Ms. Saroj Maniar, CA Question: I am residing in

Singapore and I plan on purchasing a commercial property in India. Can a

non-resident Indian (NRI) purchase commercial property in India? I…

SBI CAPGAINS PLUS (CAPITAL GAIN SCHEME)

Sold a

Property? Deposit the amount that you propose to invest in

a residential property in due course* or any other specified asset to claim

exemption of Long Term Capital Gains Tax on sale of Capital Assets # in State

Bank of India’s CapGains Plus, under the Capital Gain…

Property Sale: Long-term capital gains can be exempt from tax if invested in the right avenues

How can I

save on capital gains tax if I want to sell a plot of land that I own? — S. Baghel Ans by by Ms. Parizad Sirwalla, KPMG In the

absence of complete facts, we have assumed that you have held the plot of land

for more than 36 months from the date of acquisition and acc…

Deduct 1 per cent Tax At Source While Buying Property Above Rs .50 Lac..!

Mr. Vineet Agarwal, Director, KPMG As

per a newly introduced section in the Income -Tax Act, 1961, (I T Act), a tax

at the rate of 1 % will be deducted on transfer of immovable property of Rs. 50

lakh & above. These

changes are effective from June 1, 2013, and immovable …

FINANCIAL YEAR 2013-14 : COST INFLATION INDEX 939

Investment GuruSunday, June 09, 2013MF - Capital Gains Tax, Real Estate - Capital Gains Tax, TAX - Capital Gains

No comments

SECTION 48, EXPLANATION (v) OF INDIAN INCOME - TAX ACT,

1961 - CAPITAL GAINS - COMPUTATION OF - NOTIFIED COST INFLATION INDEX FOR

FINANCIAL YEAR (FY) 2013-14 NOTIFICATION NO. 40 / 2013 [F. NO. 142 / 7 /

2013-TPL]/SO 1464 (E), DATED 6-6-2013 In exercise of the powers conferred …

.jpg)