Provident fund (PF) withdrawal is taxable / exempt based on the type of employer and the type of provident fund. Statutory provident fund: This fund is set up under the provisions of the Provident Fund Act, 1925. This fund is maintained by Government & Semi-Government or…

Showing posts with label Provident Fund. Show all posts

Showing posts with label Provident Fund. Show all posts

How to Filing Online Employees Provident Fund Transfer Request ?.

To avoid the

Employees Provident Fund (EPF) account becoming inoperative due to change of

jobs, an employee should get his/her balance transferred to the new account

& earn interest on the consolidated

amount. Since,

October (2013) this year, when the EPFO launched its…

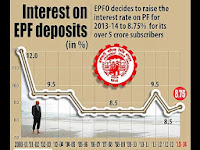

EPFO: Hikes Interest on PF to 8.75% for 2013-14

Retirement

fund body Employees' Provident Fund Organisation (EPFO) on recently decided to

increase the rate of interest on Provident Fund deposits to 8.75 % for 2013

-14, a move that will benefit nearly 5 crore subscribers. "We

have decided to recommend to the gover…

EPFO can invest up to 15% of its Corpus in Shares Are Allowed..

The share market regulator Securities & Exchange Board of India (SEBI) plans to propose that rules are tweaked to allow EPFO, which comes under the ambit of the labour ministry, to invest up to 15% of its corpus in select equity schemes. EPFO can invest up to 15% of its…

EPFO May Raise Interest rate for this fiscal Above 8.5%...!

Retirement fund body EPFO may announce higher interest rate on provident fund deposits for its above 5 crore subscribers in the current fiscal than 8.5 per cent that was provided in 2012 -13. “The rate of return on PF deposit for Employees’ Provident Fund Organisation subscri…

Employees’ Provident Funds Scheme : INVESTMENT PATTERN..

In exercise of the powers conferred by sub-paragraph (1) of paragraph 52 of the Employees’ Provident Funds Scheme, 1952 and in super session of the Notification of the Government of India in the Ministry of Labour No.S.O. 1398, dated the 11th July 1998 (dated 19-6-1998 publ…

From July 1, 2013 Online Transfer, Withdrawal of Provident Fund

by Mr. Adhil Shetty, BankBazaar.com From July 1, 2013 online transfer and withdrawal of employee’s provident fund will make the process less cumbersome and faster. How to go about it Most people who have switched jobs, have one time or / the other, faced the hurdle of recover…

Online EPF Transfer, Withdrawal from July 1, 2013... !

From July 1, 2013, employee providend fund (EPF) account holders will be able to withdraw or transfer their EPF accounts from one employer to another employer online. EPFO has said that they are working on setting up a central clearance house which will be operational from J…

Employees Provident Fund: Rate at 8.5% for 2012-13..!

The central government has finally notified the Employees' Provident Fund (EPF) rate at 8.5 % for for financial year 2013-14. . The delayed notification means that all EPF subscribers who settled or / transferred their accounts in the last 14 months would have to approac…

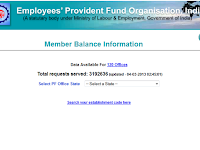

How to Check PF Balance Through Mobile Phone?

Please click on the following link to know the balance in Employees Providend Fund (EPF) Account upto the date, the accounts are updated, which also includes the latest approved transactions of settlement / advances / transfer-in / transfer-out, if any. Click http://epfoserv…

NPS, EPFO and insurance firms beginning to invest in Bond Market..!

Safety is, as it should be, the first criterion while saving for one's retirement kitty. However, safety for too long can be damaging, in terms of returns. The consumer price index (CPI) has been about 10% during the past year while the return from the employee provident…

Employees Provident Fund Organisation: Pay Higher Interest of 8.5 % for 2012-13..!

Retirement fund body EPFO ( Employees Provident Fund Organisation) recently decided to pay 8.5% interest rate to its more than 5 crore subscribers on their PF deposits for 2012-13, higher than 8.25% provided in the previous fiscal - 2012-13. The decision was taken at the meeti…

UID Number to be Aadhaar of EPFO Transfers..!

If you thought getting an Aadhaar or / unique identification (UID) number is critical only for poor households that need central government sops, think again. Middle class as well as high - income Indians with salaried jobs as well as pensioners may need a UID number to tap …

May Decide Interest on PF Deposits on Jan 15, 2013

Retirement fund body Employees' Provident Fund Organisation's (EPFO) apex decision making body Central Board of Trustees (CBT) is likely to decide rate of interest on Provident Fund (PF) deposits for 2012 - 13 in its meeting scheduled on January 15, 2013. EPFO trustee…

Save More in PF, But Take- Home Salary Reduce..!

Recent circular and intimation from the EPFO (Employees Provident Fund Organisation - which comes under the ministry of labour and employment), asking provident fund benefits to be computed not just on the basic salary and DA (Dearness Allowances) of employees as is current…

Social Security Agreements : PF Refund for Expatriates..!

Expatriates from some countries may soon be able to withdraw their PF (provident funds) before they reach 58 years. The ministry of labour & employment has issued a notification last month (October 2012) allowing PF refund for expatriates coming from countries that have …

EPFO: Introduces Employee Passbook for PF Members

The EPFO (Employees’Provident Fund Organization) had recently started the ECR (Electronic Challan cum Return) facility for employers for promoting a prompt and transparent service. E-Passbook..! Now, EPFO has issued a circular on introducing a facility of E-Passbook to Provid…