Post Office Savings Account - 4%, Minimum Rs. 20 for opening Interest payable,

Rates, Periodicity etc. Minimum Amount for

opening of account and maximum balance that can be retained 4.0% per annum on

individual / joint accounts Minimum INR 20/- for

opening Salient featur…

Showing posts with label Post Office Savings. Show all posts

Showing posts with label Post Office Savings. Show all posts

Post Office RD- 5 years - 7.4%

Investment GuruSaturday, September 24, 2016Fixed Deposit, News - SEPTEMBER 2016, Post Office Savings

No comments

Post Office Recurring Deposit Account of 5 years -

7.4% Post Office Recurring Deposit of 5 years

provides 7.4% interest rates and it is compounded every quarter. Such saving scheme gives the highest returns

compared to bank RD rates. This scheme offers complete security of…

PPF- Public Provident Fund Account - No attachment under court decree order..!

PPF- Public Provident Fund Account - No attachment under court decree order..! 1. From 1.4.2016, interest rates are as follows:-

8.10% per annum (compounded yearly). 2. Minimum Rs. 500. Maximum Rs. 1,50,000/- in a

financial year. 3. Deposits can be made in lump-sum or in 12

in…

5 year closure allowed in Public Provident Fund ..!

5 year closure allowed in Public Provident Fund The central government on June 20, 2016 said that the public provident fund (PPF) subscribers could close their deposit accounts after 5 years for meeting medical expenses & paying fees for higher education. "A subscr…

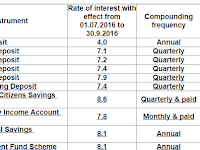

Rate of Interest on Small Saving schemes – July 1, 2016 to September 30, 2016

Rate of Interest on Small Saving schemes – July 1, 2016 to September 30, 2016 Ministry of Finance vide press release dated 20 June 2016

has revised the Rate of Interest on Small Saving schemes for the Second quarter

of financial year 2016-17 (01.07.2016

to 30.9.2016) as unde…

Income Tax Savings 80C Investment Options RETUN, RISK, LIQUIDITY, FLEXIBILITY

Investment GuruSaturday, May 14, 2016Income Tax, Income Tax - Investments, News - May 2016, Post Office Savings, Tax Saving Investment - MF

No comments

Income Tax Savings 80C Investment Options RETUN, RISK, LIQUIDITY and FLEXIBILITY

2016-17 Year From ET

Interest rate on Public Provident Fund cut to 8.1% from 8.7%

Interest rate on Public Provident Fund cut to 8.1% from 8.7% As a part of its February 16, 2016 decision to

revise interest rates on small savings every quarter, the interest rate on

Public Provident Fund (PPF) scheme will be cut to 8.1% for the period April 1

to June 30, 2…

Financial Savings of Indian Household..

Distribution of Financial Savings of Household Sector

in 2013-14 Equity Constitutes only 2.9% of the

Financial Savings of Household in India. The other investment details are given

below Investment Type % Deposits 58.80 Life Insurance Products 17 Provided Fund, Pension Funds 11.6% C…

Ponmagan Podhuvaippu Nidhi Scheme: 5 Major Points..!

The Department of Posts launched a savings scheme in

Tamil Nadu for the male child on the lines of the successful Sukanya Samriddhi

Account scheme, a top official said. The proposal to create the ‘Ponmagan Podhuvaippu Nidhi’

scheme was in the backdrop of requests from the pu…

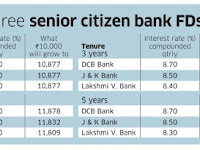

Post Office Time Deposit Account : 1 Year 8.40%.!

Interest payable annually but calculated

quarterly. From 1.4.2014, interest rates are as follows:- Period

& Rate 1 year Account

8.40% 2 year Account 8.40% 3 year Account 8.40% 5 year

Account 8.50% (Income Tax Savings) • Minimum Rs. 200 and in multiple thereof. No

maxim…