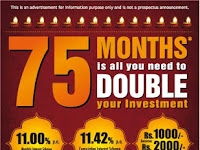

Investment Double In 75 Months NCD.

Showing posts with label NCD. Show all posts

Showing posts with label NCD. Show all posts

Muthuoot Finance NCD

Muthuoot Finance NCD.. Muthoot Finance Limited is proposing, subject to receipt of requisite approvals, market conditions and other considerations, a public offering of non convertible debentures and has filed a prospectus dated March 19, 2015 with the Registrar of Companies…

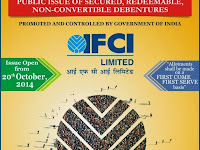

IFCI NCD: Invest now and yield upto 10% returns

IFCI NCD: Invest now and yield upto 10 per cent returns NCD Announcement Industrial Finance Corporation of India (IFCI) Limited IFCI Limited has just announced the launch of their latest NCD. You can get yield upto 10% * when you invest in the latest NCD from Industrial Finance…

IFCI : NCD Issue Opens on October 20, 2014

Industrial Finance Corporation of India (IFCI) have come with a Public issue of Secured

Redeemable Non Convertible Debentures (NCD) of Face Value of Rs.1000 each,

bearing Interest Rate of 10 per cent per annum. * NCDs will be listed in the Stock Exchanges; * Maturity period m…

DS Kulkarni NCD Issue Opens on August 4, 2014

Offering an extra

0.25% coupon rate to women investors, employees, shareholders, senior citizens,

servicemen and ex-servicemen. The Rs. 100 crore

secured non-convertible debenture (NCD) issue of developer DS Kulkarni opens on

August 4, 2014 The company has the

option to retai…

Muthoot Fincorp NCD: 12% Interest

Leading gold loan

player Muthoot Fincorp will launch its first public issue of secured,

redeemable, non-convertible debentures on Thursday. (July 3, 2015). This marks

its entry into the debt capital market. The NCDs would have a face value of Rs.

1,000 each aggregating up t…

NCD : Muthoot Finance Vs ECL Finance

From ET Many experts advise

individuals to take a call on NCDs only after considering their ratings and

post-tax returns, says Mr. Prashant Mahesh If a company goes bankrupt, secured

NCD holders will be paid off first Two non-convertible

debenture (NCD) issues from Muthoot Fi…

Edelweiss Raise RS. 400 Cr via NCDs

ECL Finance , the non-banking

finance company arm of Edelweiss Financial Services, has announced a public

issue and is looking to raise Rs.. 400 crore through non-convertible debentures

(NCDs). The base size of the

issue is Rs. 200 crore. The NCDs will carry

an interest rate…

Srei Infrastructure Finance :Rs 150 Crore NCD

Issue opens for

sbscription on May 9, 2014 and closes

on June 9, 2014 with an option for early

closure or extension by such period, which may be decided by the Board of Directors

of the Company or a duly constituted committee thereof Srei Infrastructure

Finance Limited , the 2…

IIHFL: Double your money in 6 years..

Issue size is Rs. 100

crore with an option to retain over-subscription up to Rs. 100 crore,

aggregating to a total of up to Rs. 200 crore India Infoline

Housing Finance Limited (IIHFL), the housing finance subsidiary of India

Infoline Limited, one of the largest diversified …

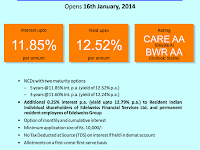

Edelweiss NCD Public Issue:11.85% Coupon Rate

Edelweiss Public Issue of 100% Secured NCDs upto 11.85%

Coupon Rate..

No Tax Deducted at Source (TDS) on interest if held in demat account

Debentures with 3 and 5 year Maturity choices. Listed on Bombay Stock

Exchange (BSE)

Issue Opens: January 16, 2014,

Issue Closes: Jan…

Edelweiss Public Issue:100% Secured NCDs upto 11.85% ..

No Tax Deducted at Source (TDS) on interest if held in demat account

Debentures with 3 and 5 year Maturity choices.

Listed on BSE

Issue Opens: Thursday, January 16, 2014,

Issue Closes: Monday, January 27,

2014

Issue Price Rs. 1,000 per NCD

Face Value Rs. 1,000 per …

TAX FREE BONDS WITH ATTRACTIVE YIELD - UPTO 9.01% p.a

NTPC

& HUDCO have come out with Tax free bonds. HUDCO bonds are rated AA+ with

maximum yield of 9.01% per annum for 20

year period. Similarly NTPC bonds have an yield of 8.91% per annum for 20 year

period. NTPC bonds are rated AAA. In

both the bonds, 10 year and 15 year…