Draft Gold Monetization Scheme Objective The objectives of the Gold Monetization Scheme (GMS) are: i. To mobilize the gold held by households and institutions in the country. ii. To provide a fillip to the gems and jewellery sector in the country by making gold available as ra…

Showing posts with label Loan - Gold. Show all posts

Showing posts with label Loan - Gold. Show all posts

How to Make Gold Monetisation Scheme Work..?

Investment GuruTuesday, May 26, 2015GOLD, Gold Investment, Gold Loan, Investing Mantra's - Gold, Loan - Gold

No comments

by Mr. Harsh Roongta, Apnapaisa.com The proposed Gold Monetisation Scheme (GMS) needs

to avoid the lacunae in the existing Gold Deposit Scheme (GDS), which could

garner only 15 tonnes. A lot of issues with the GDS had to do with

incentives to a bank for this scheme. Conceptu…

Gold Monetisation Scheme : Consider These 20 Points...1

Gold Monetisation scheme & what you should know..!. Exempt the scheme from wealth tax, capital gains tax & income tax. by Mr. Suresh Parthasarathy, Myassetsconsolidation.com You would have seen news about the Gold Monetisation Scheme and wondered whether it would be us…

RBI Raises Gold Loan Limit to Rs. 2 Lakh..!

The Reserve Bank of

India (RBI) has raised the limit for urban co-operative banks (UCBs) to

sanction loan Rs. 2 lakh against gold collateral to from Rs. 1 lakh at present. The urban

co-operative banks are allowed to give gold loan under the bullet repayment

scheme. The bullet…

Gold Loans: Interest Rate, Re - payment and Penalty

As gold loans offer flexible repayment options, these can help those

facing a temporary cash crunch. As an asset, gold is almost as liquid as cash. You can unlock the value

of your holding with a loan whenever you are in need. In fact, gold loan companies promise that you can…

Canara Bank: Gold Loans for Non-Crop Purpose!

Canara Bank: Gold Loans for Non-Crop Purpose.. (Base Rate :

10.20% with effect from 01/01/2014) Gold Loans

and GLOD for Agricultural Purposes - BR+0.25% Gold

Loans and GLOD above Rs.2 lacs up to

Rs.3 lac BR+2.25% SHG Loans: . Particulars ROI Upto Rs.3

lac BR+1 % Above Rs.3

lac Sl…

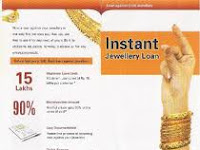

RBI hikes NBFCs’ Gold Loan Limit up from 60% to 75% of Value

In a significant breather for non-banking finance companies (NBFC), especially gold loan companies, the Reserve Bank of India (RBI) has allowed them to give higher amount of loan against gold Jewellery pledged by borrowers. NBFCs can now give up to 75%, up from 60% now, of t…

More than 50 gram Gold Coins: No Loan Facility..!??

The Reserve Bank of India (RBI) has proposed that banks restrict the facility of advancing loan against gold coins to a maximum weight of 50 grams. This move, implemented would imply that a customer can not avail loans against gold coins that weigh more than 50 grams. As per …

Federal Bank: 'Easy Gold' Loan Access Facility

Private sector lender Federal Bank has introduced a gold loan access facility for customers through the use of their debit card. The product ‘ Easy Gold ’ enables customers to withdraw or use loan amount through any ATM or at POS (point of sale) terminals. Level of finance goe…

Reserve Bank: Clamps Down on Gold Loans by NBFCs

Investment GuruFriday, March 23, 2012Gold Investment, Gold Loan, LOAN - Mortgage, Loan - Gold

No comments

In a blow to NBFCs (Non-Banking Finance Companies) in gold loan business, the RBI (Reserve Bank of India) has directed them not to give loans exceeding 60% of the value of the gold jewellery pledged with them. NBFCs primarily engaged in lending against gold jewellery have b…

RBI: Tighter regulations on gold jewel loans

At a time when the credit offtake in the banking system is not picking up, the RBI (Reserve Bank of India) has a different problem to contend with in the form of loans agains gold jewel which is growing very fast. The listed gold jewel loan firms, Manappuram Finance & …

India : Gold Loans Increase to Rs. 55,000 Crore

In India, about 200 tonnes of gold have been used as collateral to raise loans by end November in this fiscal (2011-12).

According to industry estimates nearly Rs. 55,000 crore worth of the gold has been pledged to raise loans to real estate, buy goods, fund short-term far…