Investors’ Complaints Against Mutual Funds up 40% to

17,569 in 2016-17..! Top mutual fund houses received nearly 17,569 complaints from investors in

2016-17, a surge of 40 % from the preceding fiscal, mainly due to increase in

folio numbers. These complaints pertain to data c…

Showing posts with label Investor Awareness. Show all posts

Showing posts with label Investor Awareness. Show all posts

Investments - Five Top Risks you should beware of..!

Investments - Five Top

Risks you should beware of..! By Mr. Adhil Shetty , BankBazaar.com When you invest towards a future goal, you must factor inflation into the

calculation. There’s no such thing as a risk-free investment. Your investments, and the returns you will generate…

DO NOT BE MISLED BY FALSE IMPRESSIONS ABOUT MUTUAL FUNDS

Investment GuruSunday, June 04, 2017FINANCIAL LITERACY, Investor Awareness, Mutual Funds - Alerts

No comments

DO

NOT BE MISLED BY FALSE IMPRESSIONS ABOUT MUTUAL FUNDS by Mr. Dhirendra Kumar, V alueresearchonline.com The

basic terminology of mutual funds is needlessly confusing, even

misleading. Terms like NAV and dividend do not actually mean what a

new investor would assume they mea…

Risk and Return requirements of the Investor

Investment GuruSunday, June 04, 2017FINANCIAL LITERACY, Investor Awareness, Special Articles

No comments

Risk-return

trade-off - R isk and Return requirements of the Investor. 1.

Investors seeking a high rate of return for their portfolios can hold

a dominant portion in growth assets, which provide a high return, but

also feature higher risk. 2

. Investors seeking a low level of…

India - Total Household Savings as a Percentage of the Household’s Annual Income..!

India - Total Household Savings as a Percentage of the

Household’s Annual Income..! Form SEBI Investor Survey 2015 Figure 4.3: Total Household Savings

as a Percentage of the Household’s Annual Income Savings Monthly Income Below Rs. 20,000 Rs. 20,000 - Rs.

50,000 Rs. 50000 - Rs…

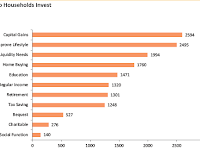

Why do Indian Households Invest? Top 10 Reasons..!

Why do Indian Households Invest? Top 11 Reasons..! Form SEBI Investor Survey 2015 1. Capital Gains 2594 2. Improve Lifestyle 2495 3. Liquidity Needs 1994 4. Home Buying 1760 5. Education 1471 6. Regular Income 1320 7. Retirement 1301 8. Tax Saving 1248 9. Bequest 527 10. Char…