5 Advantages Of ELSS Equity linked

savings scheme (ELSS) is one of the best

income tax saver scheme. It has following benefits. 1 . Investment

in the share market along with the income tax savings. 2. Maturity

amount and profit is also tax-free. 3. The lock

in period of 3 (three) …

Showing posts with label Investment - Alerts. Show all posts

Showing posts with label Investment - Alerts. Show all posts

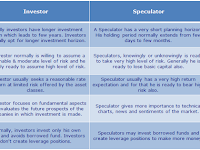

How Real Estate Investment Differs From Speculation..?

How Real Estate

Investment Differs From Speculation - by Mr. Arvind Jain, Managing Director – Pride

Group In financial circles, the terms real estate investors & real estate

speculators are used to refer to people who are buying property to make a

profit, rather than …

Investment : Without Risk There Would Be No Best Return..!

Investment : Without Risk There Would Be No Best

Return..! ‘Risk & I’: A chance to share your story and

win The say experience is the best teacher. However,

without risk there would be no new experiences, and, without new experiences,

there would be no learning, or / grow…

Credit Risk and Investments..!

Investment GuruSunday, March 20, 2016Investment - Alerts, Mutual Funds - Alerts, News - March 2016, Share Market - Alerts

No comments

Credit Risk and Investments..! By Ms. UMA SHASHIKANT, CIEL Whether it's on the stock exchange, in a bank or

in a debt fund, credit risks are everywhere. Care and diligence can go a long way in

mitigating them Credit risk is a big deal these days. While being rightly en rag…

Major Investment Options: Investment Term, Income and Taxation!

Investment GuruSunday, March 13, 2016Alerts - Income Tax, Income Tax, Investment, Investment - Alerts, News - March 2016

No comments

Major

Investment Options: Investment Term, Income and TAXATION ! Product Name Regulated Body Investment Term Income / Rate

of Interest (%) Taxation Equity SEBI Long Term 12% to 15% Tax free Above 1 Year Bonds & NCDS SEBI Short Term to Long

Term

Financial Savings of Indian Household..

Distribution of Financial Savings of Household Sector

in 2013-14 Equity Constitutes only 2.9% of the

Financial Savings of Household in India. The other investment details are given

below Investment Type % Deposits 58.80 Life Insurance Products 17 Provided Fund, Pension Funds 11.6% C…