Due date for filing ITR for FY 2015-16, AY 2016- 2017 Extended to 5th August, 2016 As per provisions of Section 139(1) of Income-tax Act 1961, Central Board of Direct Taxes extends the due date for filing returns of Income for financial year 2015-16, Assessment Year 2016- 20…

Showing posts with label Income Tax - Filing. Show all posts

Showing posts with label Income Tax - Filing. Show all posts

Why you should file your income tax return by July 31, 2016

Investment GuruMonday, July 25, 2016Income Tax - E-filing, Income Tax - Filing, JULY 2016

No comments

Why you should file your income tax return

by July 31, 2016 While

you can file your personal income tax return even after the due date,

July 31, 2016 but you would lose certain benefits if you do so. The due date for filing income tax return

for individuals-July 31 - 2016 …

Five mistakes that delay your income tax re-fund

Investment GuruWednesday, July 13, 2016Alerts - Income Tax, Income Tax - E-filing, Income Tax - Filing, JULY 2016

No comments

Five mistakes that delay your income tax re-fund By Mr. Arjit Gupta , MyTaxCafe.com In the era of e-filing, small mistakes lead either to delayed or complete

denial of income tax refunds. So, avoid these 5 common mistakes that could lead

to delay in refunds. 1. Non e-filing of…

How to efile Income Tax Return at incometaxindiaefiling.gov.in

Investment GuruThursday, July 07, 2016Income Tax - E-filing, Income Tax - Filing, JULY 2016

No comments

How to efile Income Tax Return at incometaxindiaefiling.gov.in Steps to efile your income tax return on income tax Department’s online tax filing site ( incometaxindiaefiling.gov.in ) are: Register yourself To e-file your income tax return, you will have you register on the i…

New Online Fraud in the name of Income Tax Department

Investment GuruFriday, July 01, 2016Alerts - Income Tax, Income Tax, Income Tax - E-filing, Income Tax - Filing, JULY 2016

No comments

Hi All, new online

fraud. Today I received a mail where the

mail id is correct as admin. rf06@incometaxindiaefiling. gov.in .

The logo of income tax department

is also there. The mail states that I am

qualified for a refund of Rs. 25,882.19. It further states that in order …

Income Declaration Scheme 2016- Clarifications..!

Investment GuruWednesday, June 29, 2016Alerts - Income Tax, Income Tax, Income Tax - E-filing, Income Tax - Filing, June 2016, News - June 2016

No comments

Income Declaration Scheme 2016- Clarifications..! CBDT Circular No. 17/2016, Dated: May 20, 2016 [F.No.142/8/2016-TPL] (TPL DIVISION) The Income Declaration Scheme, 2016 (hereinafter referred to as ‘the Scheme’) incorporated as Chapter IX of the Finance Act, 2016 provides an …

Income Declaration Scheme 2016- FAQs..!

Investment GuruWednesday, June 29, 2016Alerts - Income Tax, Income Tax, Income Tax - E-filing, Income Tax - Filing, June 2016, News - June 2016

No comments

Income Declaration Scheme 2016- FAQs..! The

Income Declaration Scheme, 2016 incorporated as Chapter IX of the Finance Act,

2016 is to come into force with effect from the 1 st of June,

2016. The first part of the Tax Payer Education

Series of Frequently Asked Questions (FAQs…

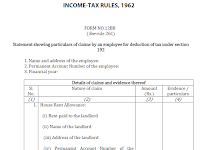

New Form to claim Tax Exemptions by Salaried Employees : Form 12BB

Investment GuruMonday, June 27, 2016Alerts - Income Tax, Income Tax, Income Tax - E-filing, Income Tax - Filing, June 2016, News - June 2015

No comments

New Form to claim Tax Exemptions by Salaried Employees : Form 12BB E mployers ask their employees to submit income tax

investment proofs along with LTA / HRA proofs. The

problem there is no standard format for the same. Each employer has different set of forms and asks for

dif…