How GST - G oods and Services Tax - will

impact your monthly budget..? by Ms. Saloni Roy,

Deloitte Haskins and Sells LLP The goods and services

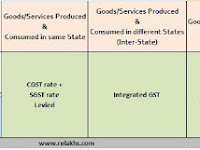

tax (GST) has brought a plethora of taxes such as service tax, VAT, excise

duty, entry tax under one single tax net. The question in …

Showing posts with label GST. Show all posts

Showing posts with label GST. Show all posts

About 75% of gold purchases in India as an investment option, Is GST impact on Gold?

About 75% of gold purchases in India as an investment option, Is GST

impact on Gold? By Mr. MP AHAMMED The

government has shown a positive intent by fixing the GST rate on gold and

jewellery at 3% which is largely a win-win formula both for the industry and

the government. En…

Applicability of GST Centre Government And State Governments..!

Applicability of GST * Centre Government And State Governments * Goods and Services Tax

As on JULY 1, 2017

Are we prepared for GST?

Are we prepared for GST? Goods and Service Tax (GST) is considered to be one of the biggest

Indirect Tax reforms in India. GST subsumes various Indirect taxes as

applicable at present in India viz., Excise duty, Service tax, VAT, CST,

Luxury tax, Entry tax, Octroi, Purchase…

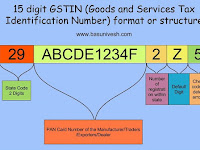

What is the structure - format of 15 digit GSTIN - Goods and Services Tax Identification Number..

What is the structure - format of 15 digit

GSTIN - Goods and Services Tax Identification Number.. From Basunivesh.com GSTIN

is a 15 digit unique code which is will be assigned to each taxpayer, which

will be State-wise and PAN-based. The structure or format of 15 digit

GSTIN …

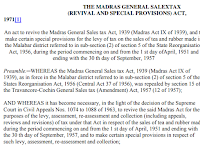

1939 Madras Sales Tax to 2017 GST

1939...Madras Sales Tax to 2017....GST 1939...Madras Sales Tax 1944 ..Central Excise Duty 1956...Central Sales Tax 1965....Octroi 1979....Entry Tax 1986....Modvat Credit 1994....Service Tax 2002....Service Tax Credit 2004....Cenvat Credit 2005....VAT 2017....GST....... Yes its an achi…

Tractor manufacturers welcome reduction of GST on exclusive tractor parts

Tractor

manufacturers welcome reduction of GST on exclusive

tractor parts The announcement of the GST council reducing GST on exclusive

tractor parts has come as great relief to the farming community, which would

otherwise have been impacted adversely. Tractor Manufacturer’s…

Overall GST is a win-win legislation, long awaited by the industry..!

Quote from Mr. C K Ranganathan,

Chairman & Managing Director – CavinKare Pvt Ltd on GST implementation in

India. Impact

of GST on consumers & industry from FMCG Industry perspective The

country would benefit immensely by the introduction of GST, a path breaking and

tr…