UTI Retirement Benefit Pension Fund

(RBPF) UTI RBPF (a

Government of India notified Pension Fund), helps to create a corpus and aims

to generate a flow of income post retirement. It helps in building a

long-term portfolio for retirement. The scheme is trusted for over 22 ye…

Showing posts with label Financial Plan - Retirement. Show all posts

Showing posts with label Financial Plan - Retirement. Show all posts

ASSET ALLOCATION - YOUNG INVESTOR, MIDLIFE INVESTOR , PRE-RETIRED INVESTOR , RETIRED INVESTOR, CONSERVATIVE INVESTOR, MODERATE INVESTOR, AGGRESSIVE INVESTOR

Investment GuruSunday, January 29, 2017Financial Plan - Asset Allocation, Financial Plan - Retirement, Financial Planning

No comments

ASSET ALLOCATION - YOUNG INVESTOR

ASSET ALLOCATION - MIDLIFE INVESTOR

ASSET ALLOCATION - PRE-RETIRED INVESTOR

ASSET ALLOCATION - RETIRED INVESTOR

by by Financial Markets The place where entities with surplus funds and those requiring funds transact business. The fin…

Indians spend more time planning their holiday than for Retirement.

Investment GuruTuesday, December 27, 2016Financial Plan - Retirement, Investing Mantra's, Investing Mantra's - Investment

No comments

Investing Mantra's Investing Mantra's - Investment Financial Plan - Retirement Indians

spend more time planning their holiday than for Retirement. By Mr. Hemant

Beniwal Certified

Financial Planner Ark

Investment Adviser www.TFLguide.com www.ArkFP.in Twitter

@HemantBeniwa…

How to stay financially fit after 60 Age?

How to stay financially fit after 60 Age? After retirement, the pressure on

finances increases in the absence of regular income. Here are some suggestions to ensure a smooth post-retirement

life. T he first fear after retirement is: Do I have

enough? It is something that rank…

Retirement Adviser Certification Examination - NISM-Series - XVII -

NISM-Series

- XVII: Retirement Adviser Certification Examination This

test is mandatory for IFAs who wish to sell NPS. In

a bid to make NPS popular, PFRDA has allowed IFAs to sell NPS with

immediate effect. The pension fund regulator has issued a circular

which has asked fina…

You Need to invest More for Retirement..!

Investment GuruMonday, August 01, 2016Financial Plan - National Pension Scheme, Financial Plan - Retirement

No comments

You

Need to invest More for Retirement by

Mr. DHIRENDRA KUMAR, Value Research The

basic numbers of saving / investing, life expectancy of people have

changed If

you want your savings to be worth more, then you should invest more. Long-term

projections Over

the last few months…

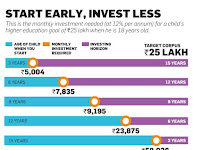

Child's Higher Education Plan : Start Early, Invest Very Less..!

Investment GuruSaturday, May 14, 2016Financial Plan - Asset Allocation, Financial Plan - Retirement, Financial Planning, MF - Child Plans

No comments

Child's Higher Education Start Early, Invest Less

Financial Planning, Retirement Planning, Asset Allocation, Mutual Fund - Child Plans

Mr. Money Mustache Interview - Early Retirement Made Easy

Mr. Money Mustache Interview - Early Retirement Made Easy

mad fientist http://www.madfientist.com - In this episode of the Financial Independence Podcast, I talk to the original Mustachian himself, Mr. Money Mustache!

How 'Mr. Money Moustache' Retired at Age 30..!

How 'Mr. Money Moustache' Retired at Age 30..!

ABC News

The family man behind the popular financial blog shares his secrets to living frugally.

How to Retire Early: The Shockingly Simple Math..!

How to Retire Early: The Shockingly Simple Math

Video School Online

Enroll in the FREE Personal Finance Principles course: http://courses.videoschoolonline.com/... How to retire early - let's break down the steps to early retirement.

What Is The 4% Rule? How Much Money Do I Need To Retire?

What Is The 4% Rule? How Much Money Do I Need To Retire?

Enroll in the FREE Personal Finance Principles course: http://courses.videoschoolonline.com/ ... In this video, I want to explain the 4% rule. This is also known as the Safe Withdrawal Rate - or basically

How to plan for Retirement? by Mr. Ramalingam K, Holistic Investment Planners Chennai

How to plan for retirement? by Ramalingam K

Src: Holisticinvestment.in

How to Plan for retirement? Important things to do before you retire.

Smart ways to Invest for Secured Retirement Corpus..!

Investment GuruSaturday, April 30, 2016Financial Plan - National Pension Scheme, Financial Plan - Retirement, Life Insurance - Pension

No comments

Smart ways to Invest for Secured

Retirement Corpus..! In order to accumulate wealth for

retirement, an individual must focus on both saving and long-term investing. In order to accumulate wealth for

retirement, an individual must focus on both saving & long-term investing…

Unit Linked Pension Plans - ULPPs - 5 Major Points

Investment GuruSunday, March 20, 2016Financial Plan - Retirement, Life Insurance - Pension

No comments

Unit Linked Pension Plans - ULPPs (1) Insurance companies offer unit

linked pension plans, which are market linked products, specifically designed

for investors looking for retirement planning products. (2) Investors have a choice about the asset

allocation of the fund they …

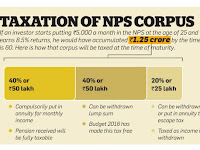

Employees' Provident Fund or National Pension Scheme : Which Can Benefit You More..?

Investment GuruSunday, March 20, 2016Financial Plan - National Pension Scheme, Financial Plan - Retirement, Provident Fund

No comments

Retirement benefits have assumed importance in

the falling interest rate scenario. In India, there are 2 such schemes: Employees' Provident Fund (EPF) scheme and the

National Pension Scheme (NPS). A recent proposal by the government to tax the

final proceeds of EPF at th…

Public Provident Fund Rate Cut: Positive for Bonds and Bond Funds..!

Investment GuruSaturday, March 19, 2016Bonds, Financial Plan - Retirement, Provident Fund, Tax Free Bonds

No comments

Public

Provident Fund Rate Cut: Positive for

Bonds and Bond Funds..! The central government has cut rates on

Public Provident Fund (PPF) from 8.7% to 8.1% & Kisan Vikas Patra from

8.7%to 7.8%. The sharp cut in PPF rates will pull down

government bond yields sharply as …

National Pension System and Provident Fund should get Same Income Tax Benefits..!

National Pension System and Provident Fund should get Same Income Tax Benefits by Mr. Harsh Roongta, Registered Investment Advisor Much has

already been written about the proposal to tax 60 per cent of the Employees'

Provident Fund (EPF) corpus on retirement and the subs…

Start planning for the second innings of life with Pension Fund

Start planning for the second innings of life with UTI Retirement Benefit Pension Fund

Have you started saving for your retirement? If not, it’s time to get started. Invest in your financial security with UTI Retirement Benefit Pension Fund and plan for a comfortable retir…

Atal Pension Yojana Eligible for Income Tax Benefits

Investment GuruSunday, March 06, 2016Alerts - Income Tax, Financial Plan - Retirement, Income Tax, Life Insurance - Pension

No comments

Atal Pension Yojana Eligible for Income Tax

Benefits INVESTORS CAN get NPS-like treatment; Additional

deduction of 50,000 under 80CCD Contributions to the Atal Pension Yojana (APY)

will now be eligible for the same tax benefits as the National Pension System

(NPS), according …