Housing For All By 2022 in India: Far-Fetched Or

Feasible? by Mr. Anuj Puri, JLL India Viewed dispassionately, the central current government's 'Housing for

all by 2022' promise seems a bit unrealistic at the moment, as the

modalities & concrete steps needed t…

Showing posts with label Budget 2015-'16. Show all posts

Showing posts with label Budget 2015-'16. Show all posts

Union Budget 2015–16 : FMC with SEBI, to Strengthen The Regulation of Commodities Market.

The Union Budget 2015 – 16 was presented by the Finance Minister Mr. Arun Jailty on February 28, 2015.

The budget 2015-16 envisages the reduction of the fiscal deficit from 4.1% of GDP during 2014–15 to 3.9% of GDP next year (2015-16).

This is wider than the previous target…

Target Rs. 69,500 Cr: Share Disinvestment Another Word for Mis-selling..?

Share Disinvestment Another Word for Mis-selling..? By Ms.Uma Shashikant, CIEL The central government plans to raise much-needed

money through selling PSU (Public Sector units) shares and the target buyer is

the retail investor, who could well be taken for a ride, says Share d…

Bank deposits are suffering in the wake of Budget 2015-16

Bank deposits are suffering in the wake of Budget 2015 After

Budget 2015 was announced there were a lot of people who were heaving a sigh of

relief because the budget had promised some interesting reforms which were all

set to help the country’s economy grow at a satisfying …

Foreign funds in Real estate: Powerful Blessing for the Indian Common Man

by Ms. Tripti Rai By the end of the year 2020, India is going to ride high on Ache Din as far as the real estate scenario is concerned. The dream of a home for every Indian by the starting of the said golden year is not that far-fetched or an anticipated gimmick to gain votes…

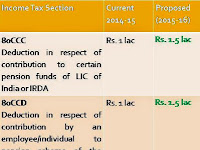

Individuals Pension Schemes: Income Tax Deductions, Changes in Budget 2015-16

Individuals Pension

Schemes: Income Tax Deductions, Changes in Budget 2015-16 Income Tax Section Current Provision (2014-15) Proposed Provision (2015-16) 80CCC Deduction in

respect of contribution to certain pension funds of LIC of India or IRDA Rs.

1,00,000 Rs. 1,50,000 80CCD D…

Budget 2015-16: Major boost for Pension Schemes & NPS...!

Budget

2015-16: Major boost for Pension Schemes & NPS...! The

additional tax incentives for investments in pension funds & the

NPS are intended to push up retiral savings in the long term. in

a bid to create a “pensioned society“, Finance Minister Mr. Arun

Jaitley ha…

Budget 2015-16: TDS introduced for RDs Interest

Budget 2015-16: TDS introduced for RDs Interest... You might not have heard this in the budget 2015-16 speech, but now the Tax Deducted at Source (TDS) will be cut even for the

recurring deposits. (RDs) Till now for so many years, TDS was deducted only in case of fixed depos…

Immoveable Property: Can Not Accept Over Rs. 20,000 in cash

Budget 2015-16: In a move that will help the Income Tax authorities keep track of money

trail, one can not accept or / repay over Rs 20,000 in cash, for any advance

towards purchase of immoveable property. Similarly, any purchase or / sale exceeding Rs. 1 lakh will now requir…

Budget 2015-16: Income Tax Neutrality in case of Merger of MF Schemes

Budget 2015-16- Income Tax Neutrality in case of Merger of MF Schemes A positive for mutual fund (MF) investors is that scheme mergers – within

equity funds or / within other categories, would not be taxed under capital

gain. In other words, such a merger would not be treat…

Budget 2015-16: Health Insurance Premium Deduction, is it very Useful?

Investment GuruWednesday, March 04, 2015Budget 2015-'16, Health insurance, Health insurance - Senior Citizen, Health insurance - Tax Benefits

No comments

The budget 2015-16 appears to encourage its citizens to get adequate

medical cover. For individuals (other than senior citizens), the deduction allowed under

Section 80D for health insurance Premium is up by Rs. 10,000 to Rs. 25,000. ( (from Rs 15,000) The deduction allowed f…

Budget 2015-16: Sovereign Gold Bondss

Budget 2015-16: Gold Invest Bonds.. To provide an opportunity to invest in gold without increasing the demand

for the yellow metal (Gold), the budget 2015-16 proposes a Sovereign Gold Bond.

It will earn interest & allow you to redeem it in cash, equivalent to

the gold fa…

Budget 2015-16: Interest exemption for Sukanya Samriddhi Scheme

While the Sukanya Samriddhi scheme

(Girl Child Savings Scheme) was earlier

declared as being eligible under Section 80C deduction (up to Rs. 1.5 lac), the

budget 2015-16 also proposes to make the interest income from the scheme exempt

from tax. This is effective the curren…

Budget 2015-16: Additional Rs. 50,000 deduction for NPS..!

In a move aimed at encouraging investors to opt for New Pension Scheme

(NPS), the budget 2015-16 proposes an additional deduction (over and above

Section 80C deduction of Rs. 1.5 lac), of Rs 50,000 under Section 80CCD for

contribution made to the new pension scheme. This is…

Service tax increased to 14% : Flats Price Up..

In Budget 2015-16, Service tax increased from 12.36% to 14%. Which resulted in Rs.20,000 to Rs.- 25,000 increase in flats cost! One last chance to save this, if any of your and your friend is eagerly searching for a right flat at right price. Please tell them to book, pay an…

Budget 2015-16: What are Income Tax Changes?

Finance Minister Mr. Arun Jaitley did not really bring in acche din for the salaried class as the income tax slabs remain unchanged. but it did offer some respite by doubling monthly transport allowance ( which is tax free) to Rs. 1600 as well as offering deductions under s…

Wealth Tax abolished from 2015-16

Budget 2015-16: Wealth Tax abolished from 2015-16

Wealth-tax Act, 1957 (‘the WT Act’) was introduced w.e.f. 1.4.1957 on the recommendation of Prof. Nicholas Kaldor for achieving twin major objectives of reducing inequalities and helping the enforcement of Income-tax Act thro…

.png)