How

are most of your investors reacting in the current market situation? Anxious

but staying put for now 53% Stopping

SIPs and/or withdrawing 19% Looking

to top up their investments 28% From https://cafemutual.com/

COVID-19 Impacts : How to tackle Equity Mutual Fund SIP Investments and Share Markets?

Investment GuruSaturday, April 04, 2020COVID-19 Impacts, Mutual Funds - Equity, Mutual Funds - SIP

No comments

How to tackle Current Markets

We understand that the current market scenario may be testing times for you. The volatility in stock markets across nations due to the Novel Coronavirus pandemic, has caught investors off guard over the past few weeks.

In such a scenario, we …

SEBI has asked AMCs to facilitate one-click MF SIP discontinuation facility on their website..!

SEBI has asked AMCs to

facilitate one-click MF SIP discontinuation facility on their website..! The Share and

Mutual Fund Regulator SEBI ( Securities and Exchange Board of India ) has asked AMFI to advise all mutual fund house / AMCs ( Asset Management Companies ) to introduce a…

Three Months Loan EMI moratorium from SBI..!

Three Months Loan EMI moratorium

from SBI..! by Suresh KP How to avail 3 Months

Loan EMI moratorium from SBI? RBI has asked banks

and financial institutions to provide 3 months loan EMI moratorium to its

customers considering Covid-19 situation. While RBI has not made

it ma…

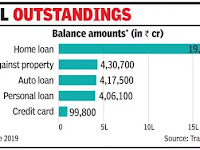

HDFC Bank: Three months Loan, Credit Card Outstanding EMI Moratorium..!

HDFC Bank: Three months Loan, Credit

Card Outstanding EMI Moratorium..! by Suresh KP How to avail HDFC Bank

Moratorium? Based on RBI Covid-19

relief measure about providing 3 months loan EMI deferment, many banks are

coming forward to provide relief up to 3 months loan EMIs…

Donations for corona till now.....

Donations for corona till now..... TATA: Rs. 1,500 crore ITC: 150 crore Hindustan unilever: 100 crore Anil agarwal (vedanta): 100 crore Hero cycle: 100 crore Bajaj group: 100 crore Shirdi temple: 51 crore BCCI: 51 crore CRPF: 33 crore Akshay Kumar, actor: 25 crore Sun phar…

Covid -19 impact: Extend date for health insurance policy renewal till April 21, 2020 IRDAI to insurers

Investment GuruThursday, April 02, 2020COVID-19 Impacts, Health insurance, Health Insurance Premium

No comments

Covid -19 impact: Extend date for health insurance policy renewal till April 21, 2020 IRDAI to insurers Insurance regulator

IRDAI has asked insurers to extend dates for renewal of health insurance

policies, which are expiring during the coronavirus lockdown duration, til…

You Can invest in E.L.S.S till 2020 June 30 to avail 80C Income Tax benefits for 2019-20

You Can

invest in E.L.S.S till 2020 June 30 to avail 80C Income Tax benefits for 2019-20

. Finance Ministry

said, “The date for making various investment / payment for claiming deduction

under Chapter –VIA - B of IT Act which includes Section 80C (Life

Insurance, PPF, NSC et…

Punjab National Bank now India’s second largest Public Sector bank

Punjab National Bank now India’s second largest Public Sector bank · United Bank of India and Oriental Bank of Commerce merged with Punjab National Bank to create second largest Public Sector bank in terms of business · The synergy from the amalgamation creates a globally compe…

EPFO introduced Pandemic Advance facility for employees.

EPFO introduced Pandemic Advance facility for employees. Any EPF member can now

withdraw upto 75% of amount in his/her EPF account or 3 months' basic

salary and dearness allowance, whichever is less. For more information

visit www.epfindia.gov.in