IPO* Worst First day Performance March 2018 * Initial Public Offer - IPO

Showing posts with label SHARE - IPO. Show all posts

Showing posts with label SHARE - IPO. Show all posts

Amber Enterprises IPO: Should you Invest?

Amber Enterprises IPO: Should you Invest? by Suresh KP Amber

Enterprises IPO - Should you Invest in this IPO? Punjab

based, Amber Enterprises IPO would open for subscription on 17th January,

2018. Amber

Enterprises IPO Ltd is a niche player in functional component manufacturi…

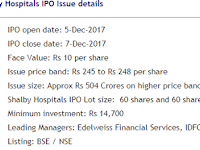

Shalby Hospitals IPO: Should you Invest?

Shalby Hospitals IPO: Should you

Invest? by Suresh KP Shalby

Hospitals IPO - Should you Invest to this IPO? Ahmedabad

based, Shalby Hospitals IPO would open for subscription on 5th December,

2017. Shalby

Limited one of the leading multi-speciality chain of hospitals in Ind…

ANI Integrated SME IPO opens on November 8, 2017

ANI Integrated SME IPO opens

on November 8, 2017 Mumbai-based ANI Integrated Services,

engaged in the business of engineering services, will be launching its SME

initial public offering on November 8, 2017 at Rs.100 a share. The Rs. 25.656-crore IPO will close on

November 10,…

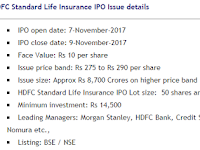

HDFC Standard Life Insurance IPO: Should you invest?

HDFC Standard Life Insurance IPO: Should you invest? by Mr. Suresh KP HDFC

Standard Life Insurance IPO - Should you invest? Mumbai

based, HDFC Standard Life Insurance IPO would open for subscription on 7th

November, 2017. HDFC

Standard Life Insurance Ltd is the third largest…

Mahindra Logistics IPO Should you Invest

Mahindra Logistics IPO Should

you Invest? by Suresh KP Mahindra

Logistics IPO - Should you Invest? Mahindra Logistics IPO would open for

subscription on 31st October, 2017. Mahindra Logistics is part of Mahindra

Group. Mahindra Logistics Ltd is a leading end to end logisti…

Reliance Nippon Life MF Looks to Raise Rs 1,524 cr Via IPO..!

Reliance

Nippon Life MF Looks to Raise Rs 1,524

cr Via IPO..! ISSUE OPENS ON OCTOBER

25, 2107 and has a price band of Rs. 247

to Rs. 252 a share Reliance Nippon Life

Asset Management, India's third largest mutual fund, will raise up to Rs. 1,524

crore through an initial…

Reliance Nippon Life MF sets IPO price band, to mop up Rs 1,542 Crore

Reliance Nippon Life MF sets IPO price

band, to mop up Rs 1,542 Crore Reliance Nippon Life Asset Management (Mutual

Fund) is aiming to raise about Rs. 1,542 crore from its initial public offering

(IPO). The company has set a price band of Rs. 247 to Rs. 252 per share for its…

General Insurance Corporation - GIC IPO – Should you invest..?

General Insurance Corporation -

GIC IPO – Should you invest..? By Mr. Suresh KP , myinvestmentideas.com General Insurance

Corporation (GIC) IPO - Should you invest? General Insurance Corporation

(GIC) IPO would open for subscription on 11th October , 2017. General Ins…

ICICI Prudential MF - Bharat 22 ETF

Investment GuruMonday, October 02, 2017Alerts - Income Tax, Mutual Fund - ETFs, OCT 2017, September 2017, SHARE - IPO, Share - ETFs

No comments

ICICI

Prudential MF - Bharat 22 ETF ICICI

Prudential Asset Management Company has filed a draft document with SEBI for

the Bharat-22 exchange-traded fund (ETF). Bharat-22

will comprise stocks of 22 blue-chip public sector units, State-owned banks and

some holdings in the Spe…

MAS Financial Services IPO: Should you invest?

MAS Financial Services IPO - Should you invest? by Mr. Suresh KP MAS Financial Services IPO - Should you invest in this IPO? MAS Financial Services IPO would open for subscription on 6th October, 2017 . MAS Financial Services Ltd is a leading NBFC company in India which his he…

Equity Markets- IPO-Mid and Small cap: Why is it better to underperform than lose money?

Investment GuruMonday, September 25, 2017September 2017, SHARE - IPO, Share Fundamentals

No comments

Equity Markets- IPO-Mid

and Small cap : Why is it better to

underperform than lose money? by Mr.

Suresh

Parthasarathy , myassetsconsolidation.com Many

investors believe wrongly that irrespective of how the economy performs, the

market will move only in one direction: upwards! I

…

ICICI Lombard – Should you invest in this IPO?

ICICI Lombard – Should you invest in this IPO? by Suresh KP ICICI Lombard IPO - Should you invest in this IPO? ICICI Lombard IPO would open for subscription on 15th September, 2017 . ICICI Lombard General Insurance Ltd is the largest private-sector non-life insurer in India. I…

SBI Life Insurance – Should you invest in this IPO?

SBI Life Insurance IPO – Should you invest in this IPO? by Mr. Suresh KP SBI Life Insurance IPO - Should you invest in this IPO? SBI Life Insurance IPO would open for subscription on 20th September, 2017 . SBI Life Insurance Ltd is India’s largest private life insurer in India…

SBI Life Insurance IPO to open on September 20, 2017

SBI Life

Insurance IPO to open on September 20, 2017 SBI Life Insurance, a

subsidiary of the country’s largest lender SBI, will hit the capital market on

2017, September 20 to raise up to Rs. 8,400 crore. The initial share sale

offer will open on September 20, 2017 and close …

SBI Life Insurance IPO - Price Band Rs. 685 to Rs. 700

T SBI

Life Insurance Company Limited – Initial Public Offer - IPO- to open on Wednesday,

September 20, 2017, and to close on Friday, September 22, 2017 Price

Band fixed from Rs. 685 per Equity Share to Rs. 700 per Equity Share SBI Life Insurance Company Limited (" Company …