LIC

Jeevan Shanti Guaranteed Pension Plan – Should I opt? Plan This is a single premium plan wherein the

Policyholder has an option to choose an Immediate or Deferred annuity. The annuity rates are guaranteed at the inception

of the policy for both Immediate and D…

Showing posts with label Financial Plan - Retirement. Show all posts

Showing posts with label Financial Plan - Retirement. Show all posts

National Pension Scheme- NPS Sow at a young age to reap at ripe at age

Investment GuruFriday, September 28, 2018Financial Plan - National Pension Scheme, Financial Plan - Retirement, SEP 2018

No comments

National Pension Scheme- NPS Sow at a young age to reap at ripe at age Financial Plan - National Pension Scheme Financial Plan - Retirement,

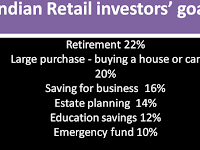

Indian retail investors : 63% are interested in goal based products..!

Investment GuruSunday, April 22, 2018FINANCIAL LITERACY, Financial Plan - Asset Allocation, Financial Plan - Estate Plan, Financial Plan - Retirement, Financial Plan - Wealth Creation, Financial Planning

No comments

Indian retail investors : 63% are interested in goal based

products ..! While 22%

retail investors invest their money for their sunset days, 20% invest to buy a

house or car. Retirement and investing for a large purchase, such as

house or car, are the top priorities for Indi…

Retirement Planning ,Starting early is not a choice, it is a must

Investment GuruSunday, October 15, 2017Financial Plan - National Pension Scheme, Financial Plan - Retirement, Financial Planning, OCT 2017

No comments

Retirement Planning , Starting early is not a choice,

it is a must By Mr. Jose John, Max Life Insurance India is often

called a young country. As per the current predictions India’s youth population

(15-29 years) is going to cross 45 crore by 2021. Thus by 2020 India is all set…

Are you nearing retirement? Here is where you should invest your corpus

Are you nearing retirement? Here is where you should invest your corpus When it comes to retirement planning it is essential to identify

the monthly cash flow required. Sarbajeet

K Sen Moneycontrol News “When it comes to retirement planning, especially on post

retirement, it is…

STRESS-FREE RETIRED LIFE DO's AND DONT's

STRESS-FREE RETIRED LIFE DO's AND DONT's · Remember the main objective for a

retirement planning is to make your later life tension free. So prefer not to

take excessive risks with your investments. You can take some risks when you

start, but as you grow older, reduce…

INVEST EARLY FOR A STRESS-FREE RETIRED LIFE..!

INVEST EARLY

FOR A STRESS-FREE RETIRED LIFE..! From UTI MF HAVING A WORRY-FREE

RETIRED LIFE REQUIRES A GOOD RETIREMENT CORPUS. BUT BUILDING ONE IS AN

EXHAUSTIVE PROCESS AND SHOULD START AS SOON AS ONE STARTS EARNING Retirement is one stage

in life which simply cannot be wished…

New Financial Planing : Salary = Fixed costs – Investments – savings – expenditure..!

Investment GuruTuesday, June 13, 2017FINANCIAL LITERACY, Financial Plan - Books, Financial Plan - Retirement, Financial Planning, Investor Awareness

No comments

New Financial Planing : Salary = Fixed costs – Investments –

savings – expenditure..! By Mr.Pranav, Co-Author of the

book “GameChanger” Personal finance writers

believe about 10% of your income is a good amount for investments. Again, if you figure you

had give more importanc…